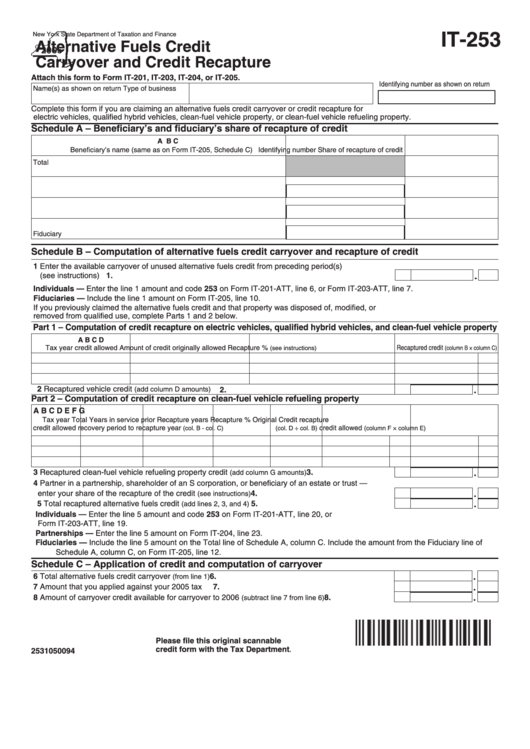

IT-253

New York State Department of Taxation and Finance

Alternative Fuels Credit

Carryover and Credit Recapture

Attach this form to Form IT-201, IT-203, IT-204, or IT-205.

Identifying number as shown on return

Name(s) as shown on return

Type of business

Complete this form if you are claiming an alternative fuels credit carryover or credit recapture for

electric vehicles, qualified hybrid vehicles, clean-fuel vehicle property, or clean-fuel vehicle refueling property.

Schedule A – Beneficiary’s and fiduciary’s share of recapture of credit

A

B

C

Beneficiary’s name (same as on Form IT-205, Schedule C)

Identifying number

Share of recapture of credit

Total

Fiduciary

Schedule B – Computation of alternative fuels credit carryover and recapture of credit

1 Enter the available carryover of unused alternative fuels credit from preceding period(s)

(see instructions) .................................................................................................................................

1.

Individuals — Enter the line 1 amount and code 253 on Form IT-201-ATT, line 6, or Form IT-203-ATT, line 7.

Fiduciaries — Include the line 1 amount on Form IT-205, line 10.

If you previously claimed the alternative fuels credit and that property was disposed of, modified, or

removed from qualified use, complete Parts 1 and 2 below.

Part 1 – Computation of credit recapture on electric vehicles, qualified hybrid vehicles, and clean-fuel vehicle property

A

B

C

D

Tax year credit allowed

Amount of credit originally allowed

Recapture %

Recaptured credit

(see instructions)

(column B × column C)

2 Recaptured vehicle credit

(add column D amounts) ............................................................................................

2.

Part 2 – Computation of credit recapture on clean-fuel vehicle refueling property

A

B

C

D

E

F

G

Tax year

Total

Years in service prior Recapture years

Recapture %

Original

Credit recapture

credit allowed

recovery period

to recapture year

credit allowed

(col. B - col. C)

(col. D ÷ col. B)

(column F × column E)

3 Recaptured clean-fuel vehicle refueling property credit

...................................

3.

(add column G amounts)

4 Partner in a partnership, shareholder of an S corporation, or beneficiary of an estate or trust —

4.

enter your share of the recapture of the credit

.........................................................

(see instructions)

5 Total recaptured alternative fuels credit

................................................................

5.

(add lines 2, 3, and 4)

Individuals — Enter the line 5 amount and code 253 on Form IT-201-ATT, line 20, or

Form IT-203-ATT, line 19.

Partnerships — Enter the line 5 amount on Form IT-204, line 23.

Fiduciaries — Include the line 5 amount on the Total line of Schedule A, column C. Include the amount from the Fiduciary line of

Schedule A, column C, on Form IT-205, line 12.

Schedule C – Application of credit and computation of carryover

6 Total alternative fuels credit carryover

6.

................................................................................

(from line 1)

7 Amount that you applied against your 2005 tax ....................................................................................

7.

8 Amount of carryover credit available for carryover to 2006

............................

8.

(subtract line 7 from line 6)

Please file this original scannable

credit form with the Tax Department.

2531050094

1

1