Instructions for Completing

Amended Consolidated Special Fuel Monthly Tax Return

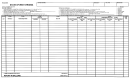

SF-900X

Refund Due: If Column C, Section 4, line 4 is less

Who should file this return?

than Column C, Section 4, line 5, you are due a refund.

Enter the amount of your calculated refund in Column

You should file this form if you are an Indiana licensed

C, Section 4, line 6 in brackets [example].

special fuel supplier, permissive supplier, exporter,

importer, blender or dyed fuel user and you need to

Sign your return, and be sure that it is mailed and

amend or change a previously filed Consolidated Special

postmarked within the statute of limitations period. Your

Fuel Monthly Tax Return, Form SF-900.

claim for refund will be processed within 90 days of

receipt; your refund will be issued, or you will receive an

Completing the Form

explanation for why the refund was denied or reduced.

You should refer to the instructions for your original

* Licensed Indiana suppliers and permissive

Consolidated Special Fuel Monthly Tax Return, and

suppliers must make all payments by Electronic

related schedules, for the tax period being amended.

Funds Transfer.

Enter your company’s identifying information on form

What is the Statute of Limitations

SF-900X and all accompanying schedules. Complete all

Period for Refunds?

information, leaving nothing blank. It is critical that you

use the same license number on this report that is shown

Generally, you have three (3) years from the date the

on your actual license. A separate SF-900X must be filed

fuel was purchased and the tax paid to claim a refund.

for each tax period requiring an amendment.

What if I Have Other Questions?

Column A: Complete column A by entering the amounts

as reported on your original tax return, or as previously

If you have other questions, contact our office by call-

amended. (If previously amended, column A will be the

ing (317) 615-2630. You may email us at

amounts reported in column C of the previously filed

fetax@dor.in.gov, or you can write to us at:

amended return.)

Indiana Department of Revenue

Column B: Use this column to report changes in line

P.O. Box 6080

amounts from those previously reported. Changes

Indianapolis, IN 46206-6080

in column B must be documented by attaching the

corresponding schedules, as amended. If there is no

change to a particular line entry, enter zero (-0-).

Column C: This column is calculated by changing the

amounts reported in column A according to any changes

made in Column B. All lines must be completed even if

some lines do not change.

Amount Due: If Column C, Section 4, line 4 is greater

than Column C, Section 4, line 5, you owe additional

tax. Enter this amount in Column C, Section 4, line 6.

This is the amount of tax due. Caution: The amount

of tax you owe should be increased by the penalty and

interest due on late payments. Be certain you have

completed Section 4, lines 2 and 3 to reflect any penalty

and interest due.*

1

1 2

2 3

3