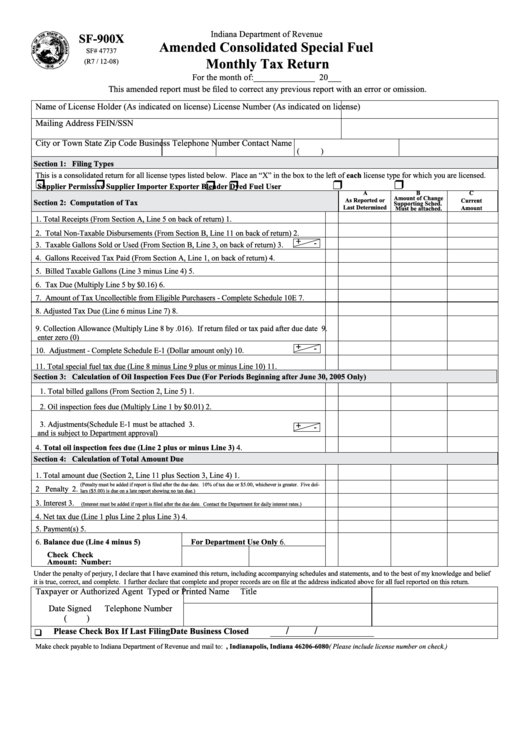

Indiana Department of Revenue

SF-900X

Amended Consolidated Special Fuel

SF# 47737

Monthly Tax Return

(R7 / 12-08)

For the month of:______________ 20___

This amended report must be filed to correct any previous report with an error or omission.

Name of License Holder (As indicated on license)

License Number (As indicated on license)

Mailing Address

FEIN/SSN

City or Town

State

Zip Code

Business Telephone Number Contact Name

(

)

Section 1: Filing Types

This is a consolidated return for all license types listed below. Place an “X” in the box to the left of each license type for which you are licensed.

Supplier

Permissive Supplier

Importer

Exporter

Blender

Dyed Fuel User

A

B

C

Amount of Change

As Reported or

Current

Section 2: Computation of Tax

Supporting Sched.

Last Determined

Amount

Must be attached.

1. Total Receipts (From Section A, Line 5 on back of return)

1.

2. Total Non-Taxable Disbursements (From Section B, Line 11 on back of return)

2.

+

-

3. Taxable Gallons Sold or Used (From Section B, Line 3, on back of return)

3.

4. Gallons Received Tax Paid (From Section A, Line 1, on back of return)

4.

5. Billed Taxable Gallons (Line 3 minus Line 4)

5.

6. Tax Due (Multiply Line 5 by $0.16)

6.

7. Amount of Tax Uncollectible from Eligible Purchasers - Complete Schedule 10E

7.

8. Adjusted Tax Due (Line 6 minus Line 7)

8.

9. Collection Allowance (Multiply Line 8 by .016). If return filed or tax paid after due date

9.

enter zero (0)

+

-

10. Adjustment - Complete Schedule E-1 (Dollar amount only)

10.

11. Total special fuel tax due (Line 8 minus Line 9 plus or minus Line 10)

11.

Section 3: Calculation of Oil Inspection Fees Due (For Periods Beginning after June 30, 2005 Only)

1. Total billed gallons (From Section 2, Line 5)

1.

2. Oil inspection fees due (Multiply Line 1 by $0.01)

2.

3. Adjustments(Schedule E-1 must be attached

3.

+

-

and is subject to Department approval)

4. Total oil inspection fees due (Line 2 plus or minus Line 3)

4.

Section 4: Calculation of Total Amount Due

1.

Total amount due (Section 2, Line 11 plus Section 3, Line 4)

1.

(Penalty must be added if report is filed after the due date. 10% of tax due or $5.00, whichever is greater. Five dol-

2

Penalty

2.

lars ($5.00) is due on a late report showing no tax due.)

3.

Interest

3.

(Interest must be added if report is filed after the due date. Contact the Department for daily interest rates.)

4.

Net tax due (Line 1 plus Line 2 plus Line 3)

4.

5.

Payment(s)

5.

6.

Balance due (Line 4 minus 5)

For Department Use Only

6.

Check

Check

Amount:

Number:

Under the penalty of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief

it is true, correct, and complete. I further declare that complete and proper records are on file at the address indicated above for all fuel reported on this return.

Taxpayer or Authorized Agent

Typed or Printed Name

Title

Date Signed

Telephone Number

(

)

/

/

Please Check Box If Last Filing

Date Business Closed

❑

Make check payable to Indiana Department of Revenue and mail to: P.O. Box 6080, Indianapolis, Indiana 46206-6080 ( Please include license number on check.)

1

1 2

2 3

3