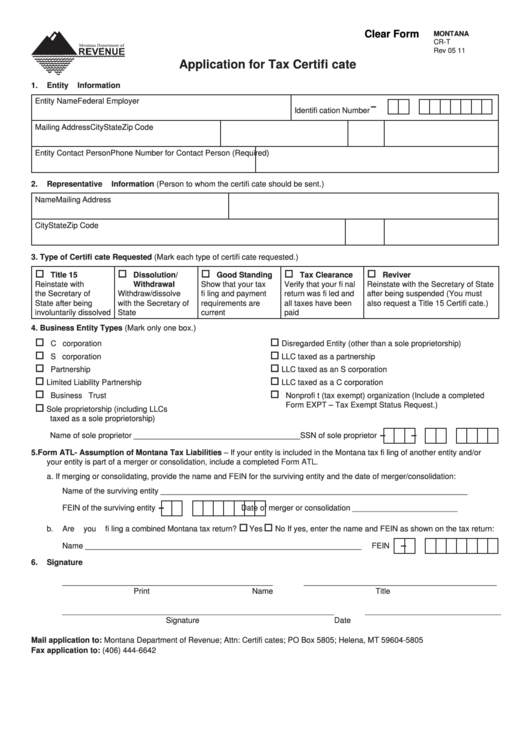

Clear Form

MONTANA

CR-T

Rev 05 11

Application for Tax Certifi cate

1.

Entity Information

Entity Name

Federal Employer

-

Identifi cation Number

Mailing Address

City

State

Zip Code

Entity Contact Person

Phone Number for Contact Person (Required)

2.

Representative Information (Person to whom the certifi cate should be sent.)

Name

Mailing Address

City

State

Zip Code

3.

Type of Certifi cate Requested (Mark each type of certifi cate requested.)

Title 15

Dissolution/

Good Standing

Tax Clearance

Reviver

Reinstate with

Withdrawal

Show that your tax

Verify that your fi nal

Reinstate with the Secretary of State

the Secretary of

Withdraw/dissolve

fi ling and payment

return was fi led and

after being suspended (You must

State after being

with the Secretary of

requirements are

all taxes have been

also request a Title 15 Certifi cate.)

involuntarily dissolved

State

current

paid

4.

Business Entity Types (Mark only one box.)

C corporation

Disregarded Entity (other than a sole proprietorship)

S corporation

LLC taxed as a partnership

Partnership

LLC taxed as an S corporation

Limited Liability Partnership

LLC taxed as a C corporation

Business Trust

Nonprofi t (tax exempt) organization (Include a completed

Form EXPT – Tax Exempt Status Request.)

Sole proprietorship (including LLCs

taxed as a sole proprietorship)

-

-

Name of sole proprietor ______________________________________ SSN of sole proprietor

5.

Form ATL- Assumption of Montana Tax Liabilities – If your entity is included in the Montana tax fi ling of another entity and/or

your entity is part of a merger or consolidation, include a completed Form ATL.

a.

If merging or consolidating, provide the name and FEIN for the surviving entity and the date of merger/consolidation:

Name of the surviving entity ______________________________________________________________________

-

FEIN of the surviving entity

Date of merger or consolidation ________________________

b.

Are you fi ling a combined Montana tax return?

Yes

No

If yes, enter the name and FEIN as shown on the tax return:

Name _______________________________________________________________

FEIN

-

6.

Signature

________________________________________________

____________________________________________

Print Name

Title

______________________________________________________________

_______________________________

Signature

Date

Mail application to: Montana Department of Revenue; Attn: Certifi cates; PO Box 5805; Helena, MT 59604-5805

Fax application to: (406) 444-6642

1

1