Instructions For Application For Registration - Coin-Operated Amusement Machine Tax

ADVERTISEMENT

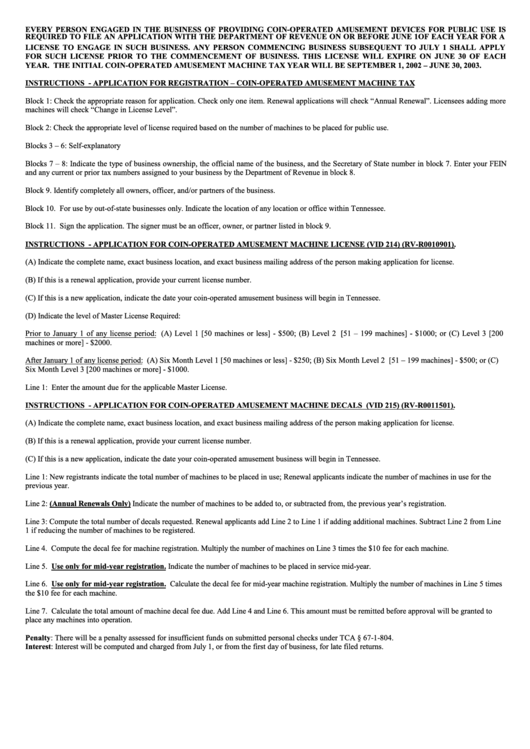

EVERY PERSON ENGAGED IN THE BUSINESS OF PROVIDING COIN-OPERATED AMUSEMENT DEVICES FOR PUBLIC USE IS

REQUIRED TO FILE AN APPLICATION WITH THE DEPARTMENT OF REVENUE ON OR BEFORE JUNE 1 OF EACH YEAR FOR A

LICENSE TO ENGAGE IN SUCH BUSINESS. ANY PERSON COMMENCING BUSINESS SUBSEQUENT TO JULY 1 SHALL APPLY

FOR SUCH LICENSE PRIOR TO THE COMMENCEMENT OF BUSINESS. THIS LICENSE WILL EXPIRE ON JUNE 30 OF EACH

YEAR. THE INITIAL COIN-OPERATED AMUSEMENT MACHINE TAX YEAR WILL BE SEPTEMBER 1, 2002 – JUNE 30, 2003.

INSTRUCTIONS - APPLICATION FOR REGISTRATION – COIN-OPERATED AMUSEMENT MACHINE TAX

Block 1: Check the appropriate reason for application. Check only one item. Renewal applications will check “Annual Renewal”. Licensees adding more

machines will check “Change in License Level”.

Block 2: Check the appropriate level of license required based on the number of machines to be placed for public use.

Blocks 3 – 6: Self-explanatory

Blocks 7 – 8: Indicate the type of business ownership, the official name of the business, and the Secretary of State number in block 7. Enter your FEIN

and any current or prior tax numbers assigned to your business by the Department of Revenue in block 8.

Block 9. Identify completely all owners, officer, and/or partners of the business.

Block 10. For use by out-of-state businesses only. Indicate the location of any location or office within Tennessee.

Block 11. Sign the application. The signer must be an officer, owner, or partner listed in block 9.

INSTRUCTIONS - APPLICATION FOR COIN-OPERATED AMUSEMENT MACHINE LICENSE (VID 214) (RV-R0010901).

(A) Indicate the complete name, exact business location, and exact business mailing address of the person making application for license.

(B) If this is a renewal application, provide your current license number.

(C) If this is a new application, indicate the date your coin-operated amusement business will begin in Tennessee.

(D) Indicate the level of Master License Required:

Prior to January 1 of any license period: (A) Level 1 [50 machines or less] - $500; (B) Level 2 [51 – 199 machines] - $1000; or (C) Level 3 [200

machines or more] - $2000.

After January 1 of any license period: (A) Six Month Level 1 [50 machines or less] - $250; (B) Six Month Level 2 [51 – 199 machines] - $500; or (C)

Six Month Level 3 [200 machines or more] - $1000.

Line 1: Enter the amount due for the applicable Master License.

INSTRUCTIONS - APPLICATION FOR COIN-OPERATED AMUSEMENT MACHINE DECALS (VID 215) (RV-R0011501).

(A) Indicate the complete name, exact business location, and exact business mailing address of the person making application for license.

(B) If this is a renewal application, provide your current license number.

(C) If this is a new application, indicate the date your coin-operated amusement business will begin in Tennessee.

Line 1: New registrants indicate the total number of machines to be placed in use; Renewal applicants indicate the number of machines in use for the

previous year.

Line 2: (Annual Renewals Only) Indicate the number of machines to be added to, or subtracted from, the previous year’s registration.

Line 3: Compute the total number of decals requested. Renewal applicants add Line 2 to Line 1 if adding additional machines. Subtract Line 2 from Line

1 if reducing the number of machines to be registered.

Line 4. Compute the decal fee for machine registration. Multiply the number of machines on Line 3 times the $10 fee for each machine.

Line 5. Use only for mid-year registration. Indicate the number of machines to be placed in service mid-year.

Line 6. Use only for mid-year registration. Calculate the decal fee for mid-year machine registration. Multiply the number of machines in Line 5 times

the $10 fee for each machine.

Line 7. Calculate the total amount of machine decal fee due. Add Line 4 and Line 6. This amount must be remitted before approval will be granted to

place any machines into operation.

Penalty: There will be a penalty assessed for insufficient funds on submitted personal checks under TCA § 67-1-804.

Interest: Interest will be computed and charged from July 1, or from the first day of business, for late filed returns.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1