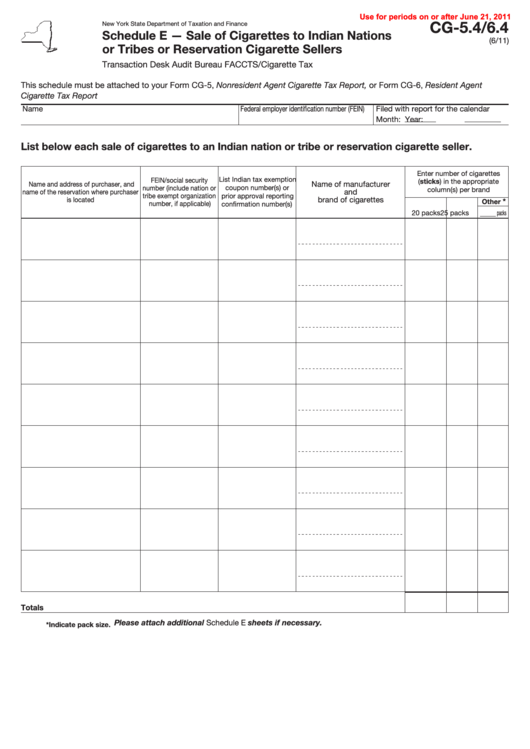

Form Cg-5.4/6.4 - Sale Of Cigarettes To Indian Nations Or Tribes Or Reservation Cigarette Sellers - 2011

ADVERTISEMENT

Use for periods on or after June 21, 2011

CG-5.4/6.4

New York State Department of Taxation and Finance

Schedule E — Sale of Cigarettes to Indian Nations

(6/11)

or Tribes or Reservation Cigarette Sellers

Transaction Desk Audit Bureau FACCTS/Cigarette Tax

This schedule must be attached to your Form CG-5, Nonresident Agent Cigarette Tax Report, or Form CG-6, Resident Agent

Cigarette Tax Report

Name

Federal employer identification number (FEIN)

Filed with report for the calendar

Month:

Year:

List below each sale of cigarettes to an Indian nation or tribe or reservation cigarette seller.

Enter number of cigarettes

List Indian tax exemption

FEIN/social security

(sticks) in the appropriate

Name of manufacturer

Name and address of purchaser, and

number (include nation or

coupon number(s) or

column(s) per brand

and

name of the reservation where purchaser

tribe exempt organization

prior approval reporting

brand of cigarettes

is located

*

Other

number, if applicable)

confirmation number(s)

20 packs

25 packs

packs

Totals ........................................................................................................................................................................

Please attach additional Schedule E sheets if necessary.

* Indicate pack size.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2