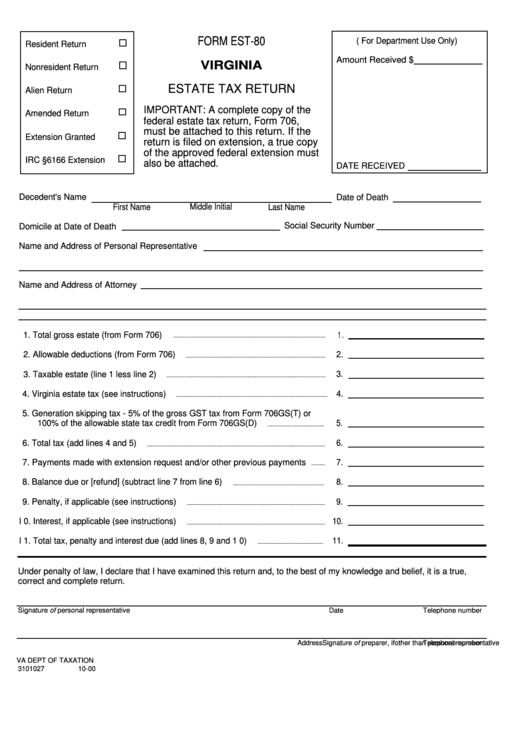

FORM EST-80

( For Department Use Only)

Resident Return

Amount Received $

VIRGINIA

Nonresident Return

ESTATE TAX RETURN

Alien Return

IMPORTANT: A complete copy of the

Amended Return

federal estate tax return, Form 706,

must be attached to this return. If the

Extension Granted

return is filed on extension, a true copy

of the approved federal extension must

IRC §6166 Extension

also be attached.

DATE RECEIVED

Decedent's Name

Date of Death

Middle Initial

First Name

Last Name

Social Security Number

Domicile at Date of Death

Name and Address of Personal Representative

Name and Address of Attorney

1. Total gross estate (from Form 706)

1 .

2. Allowable deductions (from Form 706)

2.

3. Taxable estate (line 1 less line 2)

3.

4. Virginia estate tax (see instructions)

4.

5. Generation skipping tax - 5% of the gross GST tax from Form 706GS(T) or

100% of the allowable state tax credit from Form 706GS(D)

5.

6. Total tax (add lines 4 and 5)

6.

7. Payments made with extension request and/or other previous payments

7.

8. Balance due or [refund] (subtract line 7 from line 6)

8.

9. Penalty, if applicable (see instructions)

9.

I 0. Interest, if applicable (see instructions)

10.

I 1. Total tax, penalty and interest due (add lines 8, 9 and 1 0)

11.

Under penalty of law, I declare that I have examined this return and, to the best of my knowledge and belief, it is a true,

correct and complete return.

Signature of personal representative

Telephone number

Date

Signature of preparer, if other than personal representative

Address

Telephone number

VA DEPT OF TAXATION

3101027

10-00

1

1