Form Me. B-9.3 - Verification Of Earning

ADVERTISEMENT

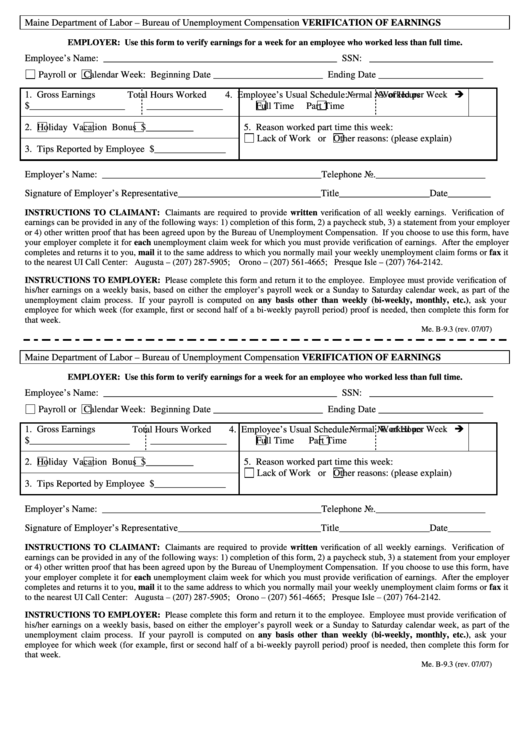

Maine Department of Labor – Bureau of Unemployment Compensation

VERIFICATION OF EARNINGS

EMPLOYER: Use this form to verify earnings for a week for an employee who worked less than full time.

Employee’s Name: _________________________________________________ SSN: __________________________

Payroll or

Calendar Week: Beginning Date _______________________ Ending Date ______________________

1. Gross Earnings

Total Hours Worked

4. Employee’s Usual Schedule:

Normal No. of Hours

Worked per Week

$____________________

________________

Full Time

Part Time

2.

Holiday

Vacation

Bonus $__________

5. Reason worked part time this week:

Lack of Work or

Other reasons: (please explain)

3. Tips Reported by Employee $_______________

Employer’s Name: ______________________________________________Telephone No._______________________

Signature of Employer’s Representative______________________________Title___________________Date_________

INSTRUCTIONS TO CLAIMANT: Claimants are required to provide written verification of all weekly earnings. Verification of

earnings can be provided in any of the following ways: 1) completion of this form, 2) a paycheck stub, 3) a statement from your employer

or 4) other written proof that has been agreed upon by the Bureau of Unemployment Compensation. If you choose to use this form, have

your employer complete it for each unemployment claim week for which you must provide verification of earnings. After the employer

completes and returns it to you, mail it to the same address to which you normally mail your weekly unemployment claim forms or fax it

to the nearest UI Call Center: Augusta – (207) 287-5905; Orono – (207) 561-4665; Presque Isle – (207) 764-2142.

INSTRUCTIONS TO EMPLOYER: Please complete this form and return it to the employee. Employee must provide verification of

his/her earnings on a weekly basis, based on either the employer’s payroll week or a Sunday to Saturday calendar week, as part of the

unemployment claim process. If your payroll is computed on any basis other than weekly (bi-weekly, monthly, etc.), ask your

employee for which week (for example, first or second half of a bi-weekly payroll period) proof is needed, then complete this form for

that week.

Me. B-9.3 (rev. 07/07)

Maine Department of Labor – Bureau of Unemployment Compensation

VERIFICATION OF EARNINGS

EMPLOYER: Use this form to verify earnings for a week for an employee who worked less than full time.

Employee’s Name: _________________________________________________ SSN: __________________________

Payroll or

Calendar Week: Beginning Date _______________________ Ending Date ______________________

1. Gross Earnings

Total Hours Worked

4. Employee’s Usual Schedule:

Normal No. of Hours

Worked per Week

$_____________________

________________

Full Time

Part Time

2.

Holiday

Vacation

Bonus $__________

5. Reason worked part time this week:

Lack of Work or

Other reasons: (please explain)

3. Tips Reported by Employee $_______________

Employer’s Name: ______________________________________________Telephone No._______________________

Signature of Employer’s Representative______________________________Title___________________Date_________

INSTRUCTIONS TO CLAIMANT: Claimants are required to provide written verification of all weekly earnings. Verification of

earnings can be provided in any of the following ways: 1) completion of this form, 2) a paycheck stub, 3) a statement from your employer

or 4) other written proof that has been agreed upon by the Bureau of Unemployment Compensation. If you choose to use this form, have

your employer complete it for each unemployment claim week for which you must provide verification of earnings. After the employer

completes and returns it to you, mail it to the same address to which you normally mail your weekly unemployment claim forms or fax it

to the nearest UI Call Center: Augusta – (207) 287-5905; Orono – (207) 561-4665; Presque Isle – (207) 764-2142.

INSTRUCTIONS TO EMPLOYER: Please complete this form and return it to the employee. Employee must provide verification of

his/her earnings on a weekly basis, based on either the employer’s payroll week or a Sunday to Saturday calendar week, as part of the

unemployment claim process. If your payroll is computed on any basis other than weekly (bi-weekly, monthly, etc.), ask your

employee for which week (for example, first or second half of a bi-weekly payroll period) proof is needed, then complete this form for

that week.

Me. B-9.3 (rev. 07/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1