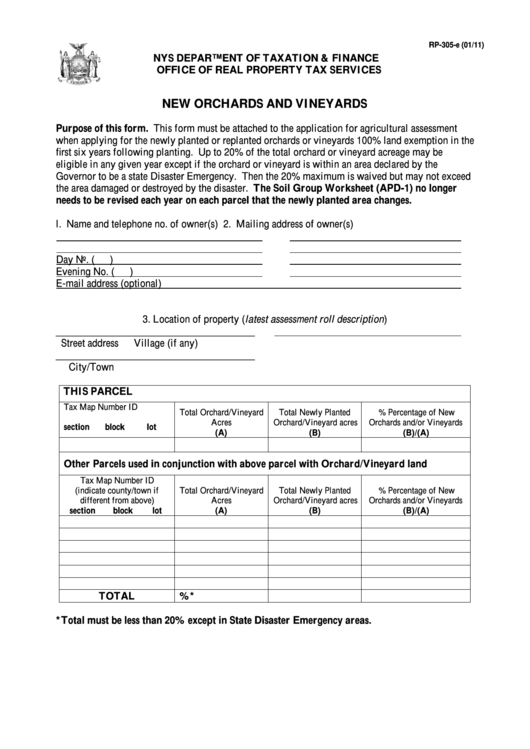

Form Rp-305-E - New Orchards And Vineyards

ADVERTISEMENT

RP-305-e (01/11)

NYS DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

NEW ORCHARDS AND VINEYARDS

Purpose of this form. This form must be attached to the application for agricultural assessment

when applying for the newly planted or replanted orchards or vineyards 100% land exemption in the

first six years following planting. Up to 20% of the total orchard or vineyard acreage may be

eligible in any given year except if the orchard or vineyard is within an area declared by the

Governor to be a state Disaster Emergency. Then the 20% maximum is waived but may not exceed

the area damaged or destroyed by the disaster. The Soil Group Worksheet (APD-1) no longer

needs to be revised each year on each parcel that the newly planted area changes.

l. Name and telephone no. of owner(s)

2. Mailing address of owner(s)

Day No. (

)

Evening No. (

)

E-mail address (optional)

3. Location of property (latest assessment roll description)

______________________________________

Street address

Village (if any)

______________________________________

City/Town

THIS PARCEL

Tax Map Number ID

Total Orchard/Vineyard

Total Newly Planted

% Percentage of New

Acres

Orchard/Vineyard acres

Orchards and/or Vineyards

section

block

lot

(A)

(B)

(B)/(A)

Other Parcels used in conjunction with above parcel with Orchard/Vineyard land

Tax Map Number ID

(indicate county/town if

Total Orchard/Vineyard

Total Newly Planted

% Percentage of New

different from above)

Acres

Orchard/Vineyard acres

Orchards and/or Vineyards

section

block

lot

(A)

(B)

(B)/(A)

TOTAL

%*

*Total must be less than 20% except in State Disaster Emergency areas.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2