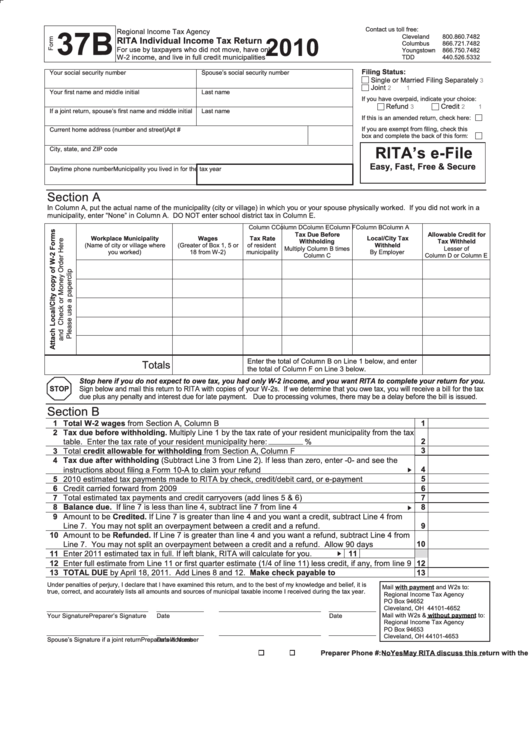

Form 37b - Individual Income Tax Return - 2010

ADVERTISEMENT

Contact us toll free:

37B

Regional Income Tax Agency

Cleveland

800.860.7482

2010

RITA Individual Income Tax Return

Columbus

866.721.7482

For use by taxpayers who did not move, have only

Youngstown

866.750.7482

W-2 income, and live in full credit municipalities

TDD

440.526.5332

Filing Status:

Your social security number

Spouse’s social security number

Single or Married Filing Separately

3

Joint

2

1

Your first name and middle initial

Last name

If you have overpaid, indicate your choice:

Refund

Credit

3

2

1

If a joint return, spouse’s first name and middle initial

Last name

If this is an amended return, check here:

If you are exempt from filing, check this

Current home address (number and street)

Apt #

box and complete the back of this form:

RITA’s e-File

City, state, and ZIP code

Easy, Fast, Free & Secure

Daytime phone number

Municipality you lived in for the tax year

Section A

In Column A, put the actual name of the municipality (city or village) in which you or your spouse physically worked. If you did not work in a

municipality, enter “None” in Column A. DO NOT enter school district tax in Column E.

Column A

Column B

Column C

Column D

Column E

Column F

Tax Due Before

Allowable Credit for

Local/City Tax

Workplace Municipality

Wages

Tax Rate

Withholding

Tax Withheld

(Name of city or village where

(Greater of Box 1, 5 or

of resident

Withheld

Multiply Column B times

Lesser of

you worked)

18 from W-2)

municipality

By Employer

Column C

Column D or Column E

Enter the total of Column B on Line 1 below, and enter

Totals

the total of Column F on Line 3 below.

Stop here if you do not expect to owe tax, you had only W-2 income, and you want RITA to complete your return for you.

STOP

Sign below and mail this return to RITA with copies of your W-2s. If we determine that you owe tax, you will receive a bill for the tax

due plus any penalty and interest due for late payment. Due to processing volumes, there may be a delay before the bill is issued.

Section B

1

Total W-2 wages from Section A, Column B

1

2

Tax due before withholding. Multiply Line 1 by the tax rate of your resident municipality from the tax

2

table. Enter the tax rate of your resident municipality here:

%

3

3

Total credit allowable for withholding from Section A, Column F

4

Tax due after withholding (Subtract Line 3 from Line 2). If less than zero, enter -0- and see the

4

instructions about filing a Form 10-A to claim your refund

5

5

2010 estimated tax payments made to RITA by check, credit/debit card, or e-payment

6

6

Credit carried forward from 2009

7

Total estimated tax payments and credit carryovers (add lines 5 & 6)

7

8

Balance due. If line 7 is less than line 4, subtract line 7 from line 4

8

9

Amount to be Credited. If Line 7 is greater than line 4 and you want a credit, subtract Line 4 from

Line 7. You may not split an overpayment between a credit and a refund.

9

10

Amount to be Refunded. If Line 7 is greater than line 4 and you want a refund, subtract Line 4 from

Line 7. You may not split an overpayment between a credit and a refund. Allow 90 days

10

11

Enter 2011 estimated tax in full. If left blank, RITA will calculate for you.

11

12

Enter full estimate from Line 11 or first quarter estimate (1/4 of line 11) less credit, if any, from line 9

12

13

TOTAL DUE by April 18, 2011. Add Lines 8 and 12. Make check payable to R.I.T.A.

13

Under penalties of perjury, I declare that I have examined this return, and to the best of my knowledge and belief, it is

Mail with payment and W2s to:

true, correct, and accurately lists all amounts and sources of municipal taxable income I received during the tax year.

Regional Income Tax Agency

PO Box 94652

Cleveland, OH 44101-4652

Mail with W2s & without payment to:

Your Signature

Date

Preparer’s Signature

Date

Regional Income Tax Agency

PO Box 94653

Cleveland, OH 44101-4653

Spouse’s Signature if a joint return

Date

Preparer’s Address

Id Number

May RITA discuss this return with the preparer shown above?

Yes

No

Preparer Phone #:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2