Instructions For Form 5300 - Application For Determination For Employee Benefit Plan - Department Of Treasury

ADVERTISEMENT

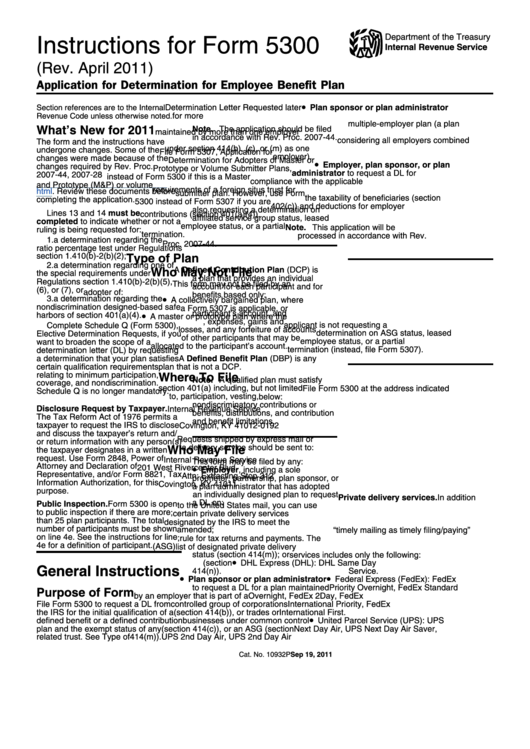

Instructions for Form 5300

Department of the Treasury

Internal Revenue Service

(Rev. April 2011)

Application for Determination for Employee Benefit Plan

•

Plan sponsor or plan administrator

Section references are to the Internal

Determination Letter Requested later

for more information.

to request a DL for a multiemployer or

Revenue Code unless otherwise noted.

multiple-employer plan (a plan

What’s New for 2011

Note. The application should be filed

maintained by more than one employer

in accordance with Rev. Proc. 2007-44.

considering all employers combined

The form and the instructions have

under section 414(b), (c), or (m) as one

undergone changes. Some of the

File Form 5307, Application for

employer).

changes were made because of the

Determination for Adopters of Master or

•

Employer, plan sponsor, or plan

changes required by Rev. Proc.

Prototype or Volume Submitter Plans,

administrator to request a DL for

2007-44, 2007-28 I.R.B. 54 available at

instead of Form 5300 if this is a Master

compliance with the applicable

and Prototype (M&P) or volume

requirements of a foreign situs trust for

html. Review these documents before

submitter plan. However, use Form

the taxability of beneficiaries (section

completing the application.

5300 instead of Form 5307 if you are

402(c)) and deductions for employer

also requesting a determination on

Lines 13 and 14 must be

contributions (section 401(a)(4)).

affiliated service group status, leased

completed to indicate whether or not a

employee status, or a partial

Note. This application will be

ruling is being requested for:

termination.

processed in accordance with Rev.

1. a determination regarding the

Proc. 2007-44.

ratio percentage test under Regulations

Type of Plan

section 1.410(b)-2(b)(2);

2. a determination regarding one of

Who May Not File

A Defined Contribution Plan (DCP) is

the special requirements under

a plan that provides an individual

Regulations section 1.410(b)-2(b)(5),

This form may not be filed by an

account for each participant and for

(6), or (7), or

adopter of:

benefits based only:

•

3. a determination regarding the

A collectively bargained plan, where

1. On the amount contributed to the

nondiscrimination designed-based safe

a Form 5307 is applicable, or

participant’s account, and

•

harbors of section 401(a)(4).

A master or prototype plan where the

2. Any income, expenses, gains and

applicant is not requesting a

Complete Schedule Q (Form 5300),

losses, and any forfeiture of accounts

determination on ASG status, leased

Elective Determination Requests, if you

of other participants that may be

employee status, or a partial

want to broaden the scope of a

allocated to the participant’s account.

termination (instead, file Form 5307).

determination letter (DL) by requesting

a determination that your plan satisfies

A Defined Benefit Plan (DBP) is any

certain qualification requirements

plan that is not a DCP.

Where To File

relating to minimum participation,

Note. A qualified plan must satisfy

coverage, and nondiscrimination.

section 401(a) including, but not limited

File Form 5300 at the address indicated

Schedule Q is no longer mandatory.

to, participation, vesting,

below:

nondiscriminatory contributions or

Disclosure Request by Taxpayer.

Internal Revenue Service

benefits, distributions, and contribution

The Tax Reform Act of 1976 permits a

P.O. Box 12192

and benefit limitations.

taxpayer to request the IRS to disclose

Covington, KY 41012-0192

and discuss the taxpayer’s return and/

Requests shipped by express mail or

or return information with any person(s)

Who May File

a delivery service should be sent to:

the taxpayer designates in a written

request. Use Form 2848, Power of

Internal Revenue Service

This form may be filed by any:

Attorney and Declaration of

•

201 West Rivercenter Blvd.

Employer, including a sole

Representative, and/or Form 8821, Tax

Attn: Extracting Stop 312

proprietor, partnership, plan sponsor, or

Information Authorization, for this

Covington, KY 41011

a plan administrator that has adopted

purpose.

an individually designed plan to request

Private delivery services. In addition

a DL on:

Public Inspection. Form 5300 is open

to the United States mail, you can use

to public inspection if there are more

1. Initial qualification of a plan;

certain private delivery services

than 25 plan participants. The total

2. Qualification of an entire plan as

designated by the IRS to meet the

number of participants must be shown

amended;

“timely mailing as timely filing/paying”

on line 4e. See the instructions for line

3. Partial termination of a plan;

rule for tax returns and payments. The

4e for a definition of participant.

4. Affiliated Service Group (ASG)

list of designated private delivery

status (section 414(m)); or

services includes only the following:

•

5. Leased employee status (section

DHL Express (DHL): DHL Same Day

General Instructions

414(n)).

Service.

•

•

Plan sponsor or plan administrator

Federal Express (FedEx): FedEx

to request a DL for a plan maintained

Priority Overnight, FedEx Standard

Purpose of Form

by an employer that is part of a

Overnight, FedEx 2Day, FedEx

File Form 5300 to request a DL from

controlled group of corporations

International Priority, FedEx

the IRS for the initial qualification of a

(section 414(b)), or trades or

International First.

•

defined benefit or a defined contribution

businesses under common control

United Parcel Service (UPS): UPS

plan and the exempt status of any

(section 414(c)), or an ASG (section

Next Day Air, UPS Next Day Air Saver,

related trust. See Type of

414(m)).

UPS 2nd Day Air, UPS 2nd Day Air

Sep 19, 2011

Cat. No. 10932P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7