Form 7510 - City Of Chicago Amusement Tax Page 7

ADVERTISEMENT

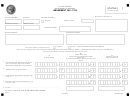

Chicago Department of Revenue

Annualization Schedule

BEGINNING PERIOD

ENDING PERIOD

ACCOUNT NUMBER

TAX CODE

Note: Please fill out this form if you meet at least one of the following criteria.

1.

You paid or remitted at least $2 million dollars for any given tax type for the preceding annual tax year.

2.

Your actual liability for this Annual Return Tax during any three consecutive calendar months of the twelve month

period immediately preceding the current Annual Tax Year was greater than 50 percent of your liability for such

Annual Return Tax for such entire twelve month period.

3.

You are a new business that began after July 1st of the current tax year (an incomplete tax year).

4.

You voluntarily elect to pay on an actual basis.

5.

You did not remit one or more payment coupons or did not file a return in the twelve-month period immediately

preceding the tax year now being filed.

Tax Computed Due

NOTE: DO NOT ENTER GROSS CHARGE/RECEIPT AMOUNTS.

(Before any applicable commission)

1.

July ..........................................................................................

0 0

2.

August .......................................................................................

0 0

3.

September .................................................................................

0 0

4.

October ......................................................................................

0 0

5.

November .................................................................................

0 0

6.

December ..................................................................................

0 0

7.

January .....................................................................................

0 0

8.

February .....................................................................................

0 0

9.

March .......................................................................................

0 0

10.

April ...........................................................................................

0 0

11.

May ............................................................................................

0 0

12. June ..........................................................................................

0 0

Total Tax Computed Due Before Any Applicable Commission.

0 0

This amount must equal the tax due before commission reported on the

tax return. Any difference will be applied to the earliest payment period.

1234505

Page 1

V3 040705

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7