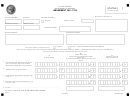

Form 7510 - City Of Chicago Amusement Tax Page 2

ADVERTISEMENT

ACCOUNT NUMBER

REVISION NUMBER

6.

Total tax due before credits and current year's tax payments (multiply line 4b by line 5b;

0

0

multiply line 4c by line 5c. Add product column b to product column c).

7.

Franchise Fee Credit .........................................................................................................

0 0

8.

Tax due before current year's tax payments (subtract line 7 from line 6)............................

0 0

9.

Current year's tax payments..............................................................................................

0 0

10.

Total tax due (subtract line 9 from line 8). If line 10 is greater than 0, enter the amount

0 0

owed. If line 10 is less than 0, please skip to line 14...........................................................

11.

Interest due for late payment (line 11c of instructions) ......................................................

0 0

12.

Penalty for late payment/filing (see instructions) ................................................................

0 0

13.

Total tax, interest, and penalty due (add lines 10, 11, and 12)

......................................

0 0

14.

Overpayment. If line 10 is less than 0, enter the amount of overpayment

......................

0 0

15.

If you want the amount of the overpayment to be credited to next year's estimated

Credit

Refund

tax, enter a check in the credit box. Otherwise, check the refund box.

NOTE: Any amounts overpaid will first be applied to deficiencies outstanding for this tax and to deficiencies for any other City of

Chicago tax for which you are registered.

751001209

Page 2

V1 010509

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7