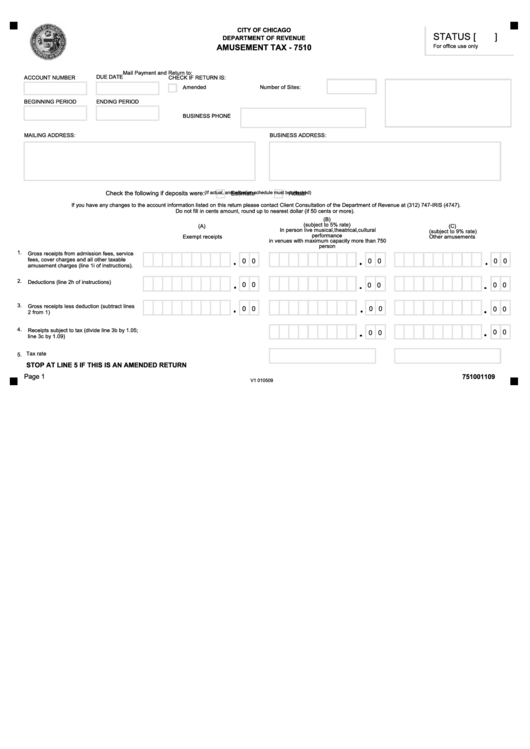

Form 7510 - City Of Chicago Amusement Tax

ADVERTISEMENT

CITY OF CHICAGO

STATUS [

]

DEPARTMENT OF REVENUE

AMUSEMENT TAX - 7510

For office use only

Mail Payment and Return to:

DUE DATE

ACCOUNT NUMBER

CHECK IF RETURN IS:

Amended

Number of Sites:

BEGINNING PERIOD

ENDING PERIOD

BUSINESS PHONE

MAILING ADDRESS:

BUSINESS ADDRESS:

Check the following if deposits were:

Estimate

Actual

(If actual, annualization schedule must be attached)

If you have any changes to the account information listed on this return please contact Client Consultation of the Department of Revenue at (312) 747-IRIS (4747).

Do not fill in cents amount, round up to nearest dollar (if 50 cents or more).

(B)

(subject to 5% rate)

(A)

(C)

In person live musical,theatrical,cultural

(subject to 9% rate)

performance

Exempt receipts

Other amusements

in venues with maximum capacity more than 750

person

1.

Gross receipts from admission fees, service

fees, cover charges and all other taxable

0 0

0 0

0 0

amusement charges (line 1i of instructions).

2.

Deductions (line 2h of instructions)...............

0 0

0 0

0 0

3.

Gross receipts less deduction (subtract lines

0 0

0 0

0 0

2 from 1) ......................................................

4.

Receipts subject to tax (divide line 3b by 1.05;

0 0

0 0

line 3c by 1.09) ...............................................

Tax rate .............................................................................................................................

5.

STOP AT LINE 5 IF THIS IS AN AMENDED RETURN

Page 1

751001109

V1 010509

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7