Instructions - Form Cca-201es

ADVERTISEMENT

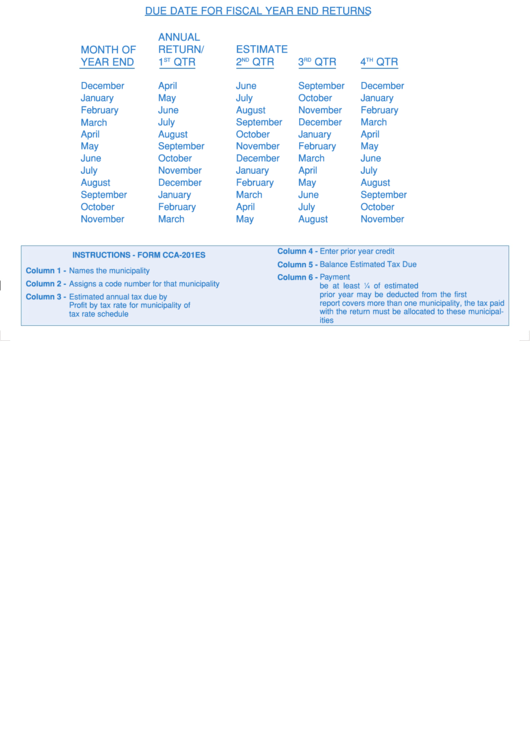

DUE DATE FOR FISCAL YEAR END RETURNS

ANNUAL

ESTIMATE

MONTH OF

RETURN/

YEAR END

1

ST

QTR

2

ND

QTR

3

RD

QTR

4

TH

QTR

December

April

June

September

December

January

May

July

October

January

February

June

August

November

February

March

July

September

December

March

April

August

October

January

April

May

September

November

February

May

June

October

December

March

June

July

November

January

April

July

August

December

February

May

August

September

January

March

June

September

October

February

April

July

October

November

March

May

August

November

Column 4 -

Enter prior year credit

INSTRUCTIONS - FORM CCA-201ES

Column 5 -

Balance Estimated Tax Due

Column 1 -

Names the municipality

Column 6 -

Payment Due. The tax paid with this declaration must

Column 2 -

Assigns a code number for that municipality

be at least

1

⁄

of estimated tax. Overpayment from

4

prior year may be deducted from the first quarter. If

Column 3 -

Estimated annual tax due by municipality. Multiply Net

report covers more than one municipality, the tax paid

Profit by tax rate for municipality of employment. See

with the return must be allocated to these municipal-

tax rate schedule

ities

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1