Form Ft-1004 - Certificate For Perchases Of Diesel Motor Fuel Or Residual Petroleum Product For Farmers And Commercial Horse Boarding Operations

ADVERTISEMENT

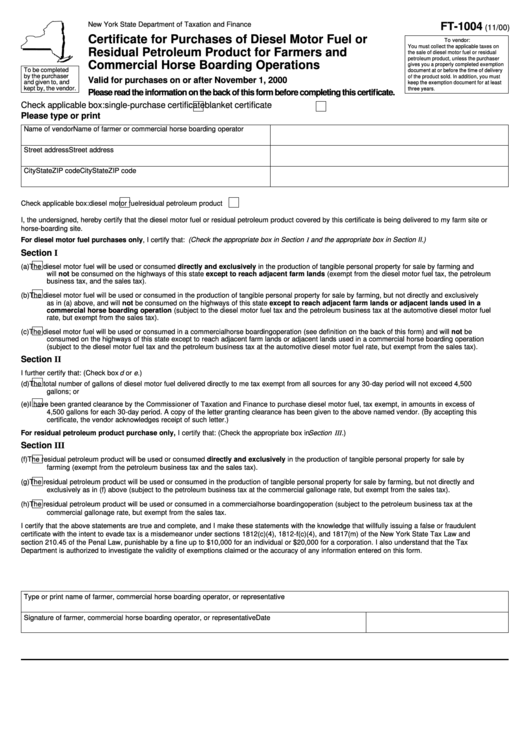

New York State Department of Taxation and Finance

FT-1004

(11/00)

Certificate for Purchases of Diesel Motor Fuel or

To vendor:

You must collect the applicable taxes on

Residual Petroleum Product for Farmers and

the sale of diesel motor fuel or residual

petroleum product, unless the purchaser

Commercial Horse Boarding Operations

gives you a properly completed exemption

To be completed

document at or before the time of delivery

by the purchaser

of the product sold. In addition, you must

Valid for purchases on or after November 1, 2000

and given to, and

keep the exemption document for at least

kept by, the vendor.

three years.

Please read the information on the back of this form before completing this certificate.

Check applicable box:

single-purchase certificate

blanket certificate

Please type or print

Name of vendor

Name of farmer or commercial horse boarding operator

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Check applicable box:

diesel motor fuel

residual petroleum product

I, the undersigned, hereby certify that the diesel motor fuel or residual petroleum product covered by this certificate is being delivered to my farm site or

horse-boarding site.

For diesel motor fuel purchases only, I certify that: (Check the appropriate box in Section I and the appropriate box in Section II.)

Section I

(a)

The diesel motor fuel will be used or consumed directly and exclusively in the production of tangible personal property for sale by farming and

will not be consumed on the highways of this state except to reach adjacent farm lands (exempt from the diesel motor fuel tax, the petroleum

business tax, and the sales tax).

(b)

The diesel motor fuel will be used or consumed in the production of tangible personal property for sale by farming, but not directly and exclusively

as in (a) above, and will not be consumed on the highways of this state except to reach adjacent farm lands or adjacent lands used in a

commercial horse boarding operation (subject to the diesel motor fuel tax and the petroleum business tax at the automotive diesel motor fuel

rate, but exempt from the sales tax).

(c)

The diesel motor fuel will be used or consumed in a commercial horse boarding operation (see definition on the back of this form) and will not be

consumed on the highways of this state except to reach adjacent farm lands or adjacent lands used in a commercial horse boarding operation

(subject to the diesel motor fuel tax and the petroleum business tax at the automotive diesel motor fuel rate, but exempt from the sales tax).

Section II

I further certify that: (Check box d or e. )

(d)

The total number of gallons of diesel motor fuel delivered directly to me tax exempt from all sources for any 30-day period will not exceed 4,500

gallons; or

(e)

I have been granted clearance by the Commissioner of Taxation and Finance to purchase diesel motor fuel, tax exempt, in amounts in excess of

4,500 gallons for each 30-day period. A copy of the letter granting clearance has been given to the above named vendor. (By accepting this

certificate, the vendor acknowledges receipt of such letter.)

For residual petroleum product purchase only, I certify that: (Check the appropriate box in Section III.)

Section III

(f)

The residual petroleum product will be used or consumed directly and exclusively in the production of tangible personal property for sale by

farming (exempt from the petroleum business tax and the sales tax).

(g)

The residual petroleum product will be used or consumed in the production of tangible personal property for sale by farming, but not directly and

exclusively as in (f) above (subject to the petroleum business tax at the commercial gallonage rate, but exempt from the sales tax).

(h)

The residual petroleum product will be used or consumed in a commercial horse boarding operation (subject to the petroleum business tax at the

commercial gallonage rate, but exempt from the sales tax.

I certify that the above statements are true and complete, and I make these statements with the knowledge that willfully issuing a false or fraudulent

certificate with the intent to evade tax is a misdemeanor under sections 1812(c)(4), 1812-f(c)(4), and 1817(m) of the New York State Tax Law and

section 210.45 of the Penal Law, punishable by a fine up to $10,000 for an individual or $20,000 for a corporation. I also understand that the Tax

Department is authorized to investigate the validity of exemptions claimed or the accuracy of any information entered on this form.

Type or print name of farmer, commercial horse boarding operator, or representative

Signature of farmer, commercial horse boarding operator, or representative

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1