Form W-1q - Employer'S Quarterly Return Of Tax Withheld - Springfield Income Tax Division

ADVERTISEMENT

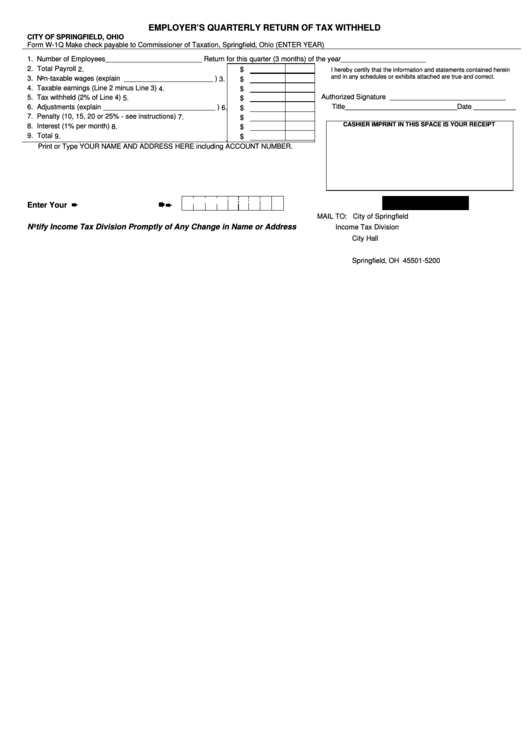

EMPLOYER’S QUARTERLY RETURN OF TAX WITHHELD

CITY OF SPRINGFIELD, OHIO

Form W-1Q

Make check payable to Commissioner of Taxation, Springfield, Ohio

(ENTER YEAR)

1. Number of Employees_________________________

Return for this quarter (3 months) of the year______________________

2. Total Payroll

2. $

I hereby certify that the information and statements contained herein

and in any schedules or exhibits attached are true and correct.

3. Non-taxable wages (explain _______________________ )

3. $

4. Taxable earnings (Line 2 minus Line 3)

4. $

Authorized Signature ______________________________

5. Tax withheld (2% of Line 4)

5. $

Title_____________________________Date ___________

6. Adjustments (explain _____________________________ )

6. $

7. Penalty (10, 15, 20 or 25% - see instructions)

7. $

CASHIER IMPRINT IN THIS SPACE IS YOUR RECEIPT

8. Interest (1% per month)

8. $

9. Total

9. $

Print or Type YOUR NAME AND ADDRESS HERE including ACCOUNT NUMBER.

RETURN THIS COPY

Enter Your F.E.I.N or S.S.N. Here

MAIL TO: City of Springfield

Notify Income Tax Division Promptly of Any Change in Name or Address

Income Tax Division

City Hall

P.O. Box 5200

Springfield, OH 45501-5200

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1