Line-By-Line Instructions For Schedule C

ADVERTISEMENT

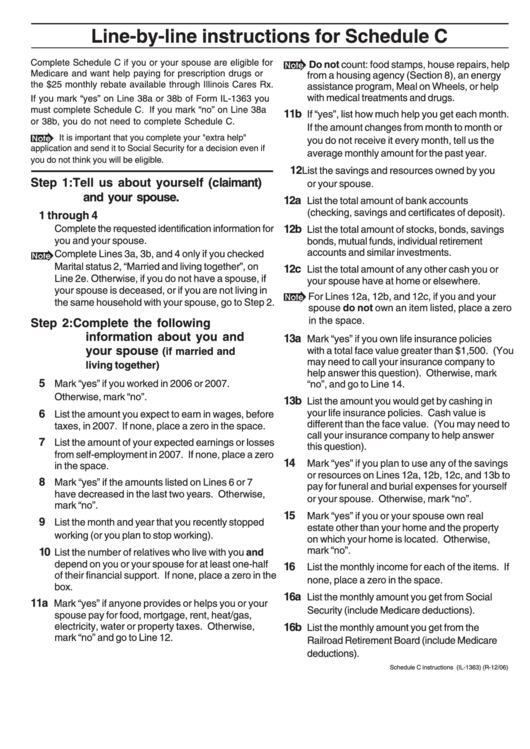

Line-by-line instructions for Schedule C

Complete Schedule C if you or your spouse are eligible for

Do not count: food stamps, house repairs, help

Medicare and want help paying for prescription drugs or

from a housing agency (Section 8), an energy

the $25 monthly rebate available through Illinois Cares Rx.

assistance program, Meal on Wheels, or help

with medical treatments and drugs.

If you mark “yes” on Line 38a or 38b of Form IL-1363 you

must complete Schedule C. If you mark “no” on Line 38a

11b

If “yes”, list how much help you get each month.

or 38b, you do not need to complete Schedule C.

If the amount changes from month to month or

It is important that you complete your "extra help"

you do not receive it every month, tell us the

application and send it to Social Security for a decision even if

average monthly amount for the past year.

you do not think you will be eligible.

12

List the savings and resources owned by you

Step 1: Tell us about yourself (claimant)

or your spouse.

and your spouse.

12a

List the total amount of bank accounts

(checking, savings and certificates of deposit).

1 through 4

Complete the requested identification information for

12b

List the total amount of stocks, bonds, savings

you and your spouse.

bonds, mutual funds, individual retirement

accounts and similar investments.

Complete Lines 3a, 3b, and 4 only if you checked

Marital status 2, “Married and living together”, on

12c

List the total amount of any other cash you or

Line 2e. Otherwise, if you do not have a spouse, if

your spouse have at home or elsewhere.

your spouse is deceased, or if you are not living in

For Lines 12a, 12b, and 12c, if you and your

the same household with your spouse, go to Step 2.

spouse do not own an item listed, place a zero

in the space.

Step 2:

Complete the following

information about you and

13a

Mark “yes” if you own life insurance policies

your spouse

with a total face value greater than $1,500. (You

(if married and

may need to call your insurance company to

living together)

help answer this question). Otherwise, mark

5

Mark “yes” if you worked in 2006 or 2007.

“no”, and go to Line 14.

Otherwise, mark “no”.

13b

List the amount you would get by cashing in

6

your life insurance policies. Cash value is

List the amount you expect to earn in wages, before

different than the face value. (You may need to

taxes, in 2007. If none, place a zero in the space.

call your insurance company to help answer

7

List the amount of your expected earnings or losses

this question).

from self-employment in 2007. If none, place a zero

14

Mark “yes” if you plan to use any of the savings

in the space.

or resources on Lines 12a, 12b, 12c, and 13b to

8

Mark “yes” if the amounts listed on Lines 6 or 7

pay for funeral and burial expenses for yourself

have decreased in the last two years. Otherwise,

or your spouse. Otherwise, mark “no”.

mark “no”.

15

Mark “yes” if you or your spouse own real

9

List the month and year that you recently stopped

estate other than your home and the property

working (or you plan to stop working).

on which your home is located. Otherwise,

mark “no”.

10

List the number of relatives who live with you and

depend on you or your spouse for at least one-half

16

List the monthly income for each of the items. If

of their financial support. If none, place a zero in the

none, place a zero in the space.

box.

16a

List the monthly amount you get from Social

11a

Mark “yes” if anyone provides or helps you or your

Security (include Medicare deductions).

spouse pay for food, mortgage, rent, heat/gas,

electricity, water or property taxes. Otherwise,

16b

List the monthly amount you get from the

mark “no” and go to Line 12.

Railroad Retirement Board (include Medicare

deductions).

Schedule C instructions (IL-1363) (R-12/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2