Instructions For Form Rew-1

ADVERTISEMENT

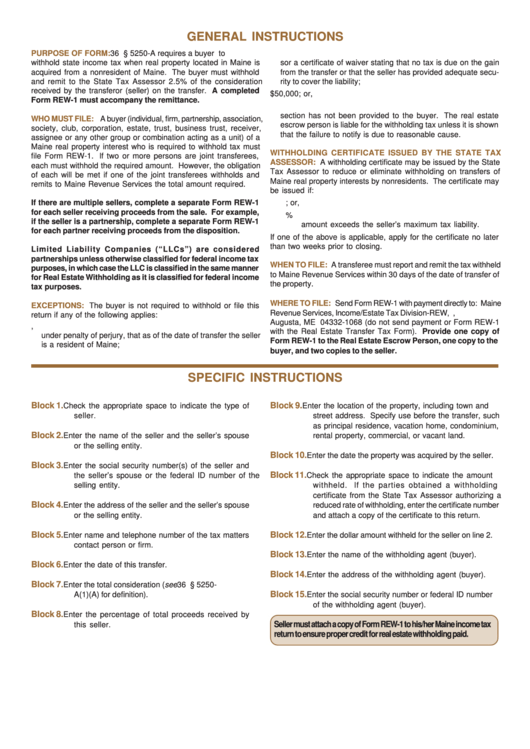

GENERAL INSTRUCTIONS

PURPOSE OF FORM:

36 M.R.S.A. § 5250-A requires a buyer to

b. The seller or the buyer has received from the State Tax Asses-

withhold state income tax when real property located in Maine is

sor a certificate of waiver stating that no tax is due on the gain

acquired from a nonresident of Maine. The buyer must withhold

from the transfer or that the seller has provided adequate secu-

and remit to the State Tax Assessor 2.5% of the consideration

rity to cover the liability;

received by the transferor (seller) on the transfer. A completed

c. The consideration for the property is less than $50,000; or,

Form REW-1 must accompany the remittance.

d. Written notification of the withholding requirements of this

section has not been provided to the buyer. The real estate

WHO MUST FILE:

A buyer (individual, firm, partnership, association,

escrow person is liable for the withholding tax unless it is shown

society, club, corporation, estate, trust, business trust, receiver,

that the failure to notify is due to reasonable cause.

assignee or any other group or combination acting as a unit) of a

Maine real property interest who is required to withhold tax must

WITHHOLDING CERTIFICATE ISSUED BY THE STATE TAX

file Form REW-1. If two or more persons are joint transferees,

ASSESSOR:

A withholding certificate may be issued by the State

each must withhold the required amount. However, the obligation

Tax Assessor to reduce or eliminate withholding on transfers of

of each will be met if one of the joint transferees withholds and

Maine real property interests by nonresidents. The certificate may

remits to Maine Revenue Services the total amount required.

be issued if:

If there are multiple sellers, complete a separate Form REW-1

1.

No tax is due on the gain from the transfer; or,

for each seller receiving proceeds from the sale. For example,

2.

Reduced withholding is appropriate because the 2.5%

if the seller is a partnership, complete a separate Form REW-1

amount exceeds the seller’s maximum tax liability.

for each partner receiving proceeds from the disposition.

If one of the above is applicable, apply for the certificate no later

than two weeks prior to closing.

Limited Liability Companies (“LLCs”) are considered

partnerships unless otherwise classified for federal income tax

WHEN TO FILE:

A transferee must report and remit the tax withheld

purposes, in which case the LLC is classified in the same manner

to Maine Revenue Services within 30 days of the date of transfer of

for Real Estate Withholding as it is classified for federal income

the property.

tax purposes.

WHERE TO FILE:

Send Form REW-1 with payment directly to: Maine

EXCEPTIONS:

The buyer is not required to withhold or file this

Revenue Services, Income/Estate Tax Division-REW, P.O. Box 1068,

return if any of the following applies:

Augusta, ME 04332-1068 (do not send payment or Form REW-1

a. The seller furnishes to the buyer written certification stating,

with the Real Estate Transfer Tax Form). Provide one copy of

under penalty of perjury, that as of the date of transfer the seller

Form REW-1 to the Real Estate Escrow Person, one copy to the

is a resident of Maine;

buyer, and two copies to the seller.

SPECIFIC INSTRUCTIONS

Block 1.

Block 9.

Check the appropriate space to indicate the type of

Enter the location of the property, including town and

seller.

street address. Specify use before the transfer, such

as principal residence, vacation home, condominium,

Block 2.

Enter the name of the seller and the seller’s spouse

rental property, commercial, or vacant land.

or the selling entity.

Block 10.

Enter the date the property was acquired by the seller.

Block 3.

Enter the social security number(s) of the seller and

Block 11.

the seller’s spouse or the federal ID number of the

Check the appropriate space to indicate the amount

selling entity.

withheld. If the parties obtained a withholding

certificate from the State Tax Assessor authorizing a

Block 4.

Enter the address of the seller and the seller’s spouse

reduced rate of withholding, enter the certificate number

or the selling entity.

and attach a copy of the certificate to this return.

Block 5.

Block 12.

Enter name and telephone number of the tax matters

Enter the dollar amount withheld for the seller on line 2.

contact person or firm.

Block 13.

Enter the name of the withholding agent (buyer).

Block 6.

Enter the date of this transfer.

Block 14.

Enter the address of the withholding agent (buyer).

Block 7.

Enter the total consideration (see 36 M.R.S.A. § 5250-

Block 15.

A(1)(A) for definition).

Enter the social security number or federal ID number

of the withholding agent (buyer).

Block 8.

Enter the percentage of total proceeds received by

Seller must attach a copy of Form REW-1 to his/her Maine income tax

this seller.

return to ensure proper credit for real estate withholding paid.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1