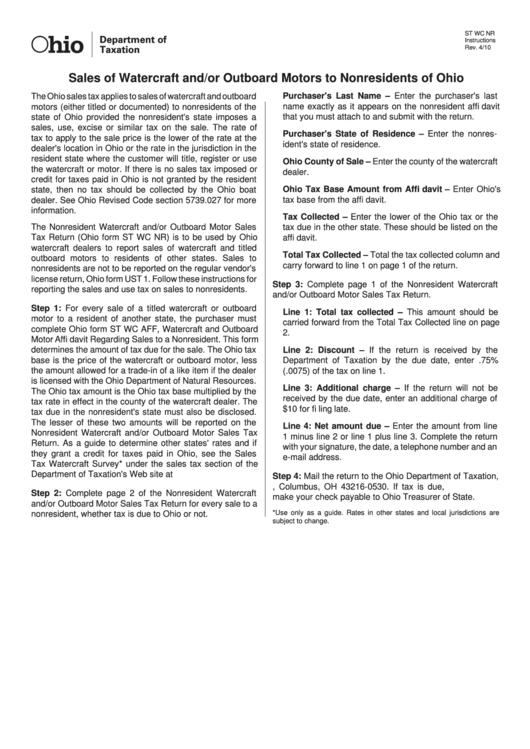

Instructions For Form St Wc Nr - Sales Of Watercraft And/or Outboard Motors To Nonresidents Of Ohio

ADVERTISEMENT

hio

ST WC NR

Department of

Instructions

Taxation

Rev. 4/10

Sales of Watercraft and/or Outboard Motors to Nonresidents of Ohio

Purchaser's Last Name – Enter the purchaser's last

The Ohio sales tax applies to sales of watercraft and outboard

name exactly as it appears on the nonresident affi davit

motors (either titled or documented) to nonresidents of the

that you must attach to and submit with the return.

state of Ohio provided the nonresident's state imposes a

sales, use, excise or similar tax on the sale. The rate of

Purchaser's State of Residence – Enter the nonres-

tax to apply to the sale price is the lower of the rate at the

ident's state of residence.

dealer's location in Ohio or the rate in the jurisdiction in the

resident state where the customer will title, register or use

Ohio County of Sale – Enter the county of the watercraft

the watercraft or motor. If there is no sales tax imposed or

dealer.

credit for taxes paid in Ohio is not granted by the resident

Ohio Tax Base Amount from Affi davit – Enter Ohio's

state, then no tax should be collected by the Ohio boat

tax base from the affi davit.

dealer. See Ohio Revised Code section 5739.027 for more

information.

Tax Collected – Enter the lower of the Ohio tax or the

The Nonresident Watercraft and/or Outboard Motor Sales

tax due in the other state. These should be listed on the

Tax Return (Ohio form ST WC NR) is to be used by Ohio

affi davit.

watercraft dealers to report sales of watercraft and titled

Total Tax Collected – Total the tax collected column and

outboard motors to residents of other states. Sales to

carry forward to line 1 on page 1 of the return.

nonresidents are not to be reported on the regular vendor's

license return, Ohio form UST 1. Follow these instructions for

Step 3: Complete page 1 of the Nonresident Watercraft

reporting the sales and use tax on sales to nonresidents.

and/or Outboard Motor Sales Tax Return.

Step 1: For every sale of a titled watercraft or outboard

Line 1: Total tax collected – This amount should be

motor to a resident of another state, the purchaser must

carried forward from the Total Tax Collected line on page

complete Ohio form ST WC AFF, Watercraft and Outboard

2.

Motor Affi davit Regarding Sales to a Nonresident. This form

determines the amount of tax due for the sale. The Ohio tax

Line 2: Discount – If the return is received by the

base is the price of the watercraft or outboard motor, less

Department of Taxation by the due date, enter .75%

the amount allowed for a trade-in of a like item if the dealer

(.0075) of the tax on line 1.

is licensed with the Ohio Department of Natural Resources.

Line 3: Additional charge – If the return will not be

The Ohio tax amount is the Ohio tax base multiplied by the

received by the due date, enter an additional charge of

tax rate in effect in the county of the watercraft dealer. The

$10 for fi ling late.

tax due in the nonresident's state must also be disclosed.

The lesser of these two amounts will be reported on the

Line 4: Net amount due – Enter the amount from line

Nonresident Watercraft and/or Outboard Motor Sales Tax

1 minus line 2 or line 1 plus line 3. Complete the return

Return. As a guide to determine other states' rates and if

with your signature, the date, a telephone number and an

they grant a credit for taxes paid in Ohio, see the Sales

e-mail address.

Tax Watercraft Survey* under the sales tax section of the

Department of Taxation's Web site at tax.ohio.gov.

Step 4: Mail the return to the Ohio Department of Taxation,

P.O. Box 530, Columbus, OH 43216-0530. If tax is due,

Step 2: Complete page 2 of the Nonresident Watercraft

make your check payable to Ohio Treasurer of State.

and/or Outboard Motor Sales Tax Return for every sale to a

*Use only as a guide. Rates in other states and local jurisdictions are

nonresident, whether tax is due to Ohio or not.

subject to change.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1