Form 941a-Me Loose - Amended Return Of Income Tax Withholding - 2005

ADVERTISEMENT

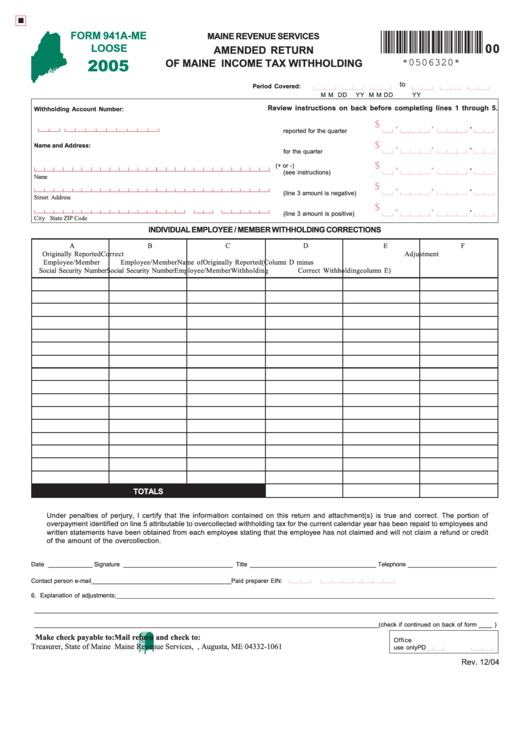

FORM 941A-ME

MAINE REVENUE SERVICES

00

LOOSE

AMENDED RETURN

2005

OF MAINE INCOME TAX WITHHOLDING

*0506320*

to

Period Covered:

M M

DD

YY

M M

DD

YY

Review instructions on back before completing lines 1 through 5.

Withholding Account Number:

$

,

,

1. Withholding originally

.

reported for the quarter ................

$

,

,

2. Correct withholding

Name and Address:

.

for the quarter ..............................

$

,

,

3. Correction amount (+ or -)

.

(see instructions) ..........................

Name

$

,

,

4. Underpayment to be paid

.

(line 3 amount is negative) ...........

Street Address

$

,

,

5. Overpayment to be refunded

.

(line 3 amount is positive) ............

City

State

ZIP Code

INDIVIDUAL EMPLOYEE / MEMBER WITHHOLDING CORRECTIONS

A

B

C

D

E

F

Originally Reported

Correct

Adjustment

Employee/Member

Employee/Member

Name of

Originally Reported

(Column D minus

Social Security Number

Social Security Number

Employee/Member

Withholding

Correct Withholding

column E)

TOTALS

Under penalties of perjury, I certify that the information contained on this return and attachment(s) is true and correct. The portion of

overpayment identified on line 5 attributable to overcollected withholding tax for the current calendar year has been repaid to employees and

TOTALS

written statements have been obtained from each employee stating that the employee has not claimed and will not claim a refund or credit

of the amount of the overcollection.

Date _____________ Signature ________________________________ Title _____________________________________ Telephone __________________________

Contact person e-mail _________________________________________ Paid preparer EIN:

6. Explanation of adjustments: _______________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________ (check if continued on back of form ____ )

Make check payable to:

Mail return and check to:

Office

Treasurer, State of Maine

Maine Revenue Services, P.O. Box 1061, Augusta, ME 04332-1061

use only

PD

Rev. 12/04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1