Print

Clear

Page 1

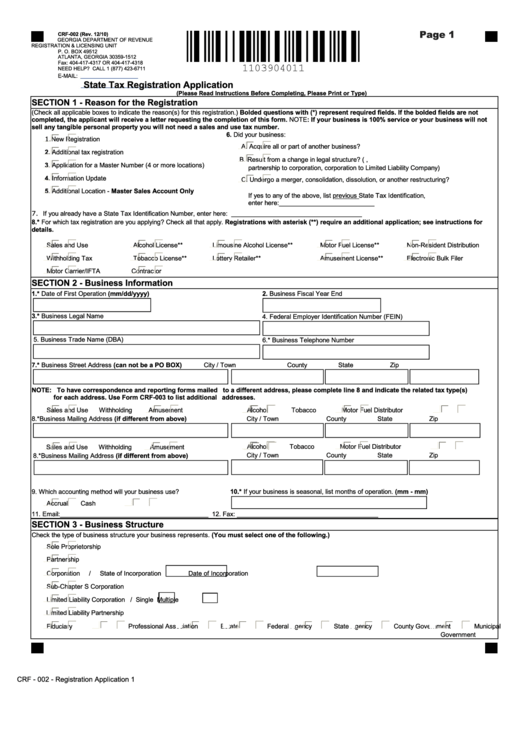

CRF-002 (Rev. 12/10)

GEORGIA DEPARTMENT OF REVENUE

REGISTRATION & LICENSING UNIT

P. O. BOX 49512

ATLANTA, GEORGIA 30359-1512

Fax: 404-417-4317 OR 404-417-4318

NEED HELP? CALL 1 (877) 423-6711

E-MAIL:

ST-License@dor.ga.gov

State Tax Registration Application

TSD-withholding-lic@dor.ga.gov

(Please Read Instructions Before Completing, Please Print or Type)

SECTION 1 - Reason for the Registration

(Check all applicable boxes to indicate the reason(s) for this registration.) Bolded questions with (*) represent required fields. If the bolded fields are not

completed, the applicant will receive a letter requesting the completion of this form. NOTE: If your business is 100% service or your business will not

sell any tangible personal property you will not need a sales and use tax number.

6. Did your business:

g

f

e

d

c

1.New Registration

g

f

e

d

c

A. Acquire all or part of another business?

g

f

e

d

c

2. Additional tax registration

g

f

e

d

c

B. Result from a change in legal structure? (e.g. from individual to partnership,

g

f

e

d

c

3. Application for a Master Number (4 or more locations)

partnership to corporation, corporation to Limited Liability Company)

g

f

e

d

c

4. Information Update

g

f

e

d

c

C. Undergo a merger, consolidation, dissolution, or another restructuring?

g

f

e

d

c

5. Additional Location - Master Sales Account Only

If yes to any of the above, list previous State Tax Identification,

enter here:___________________________

7. If you already have a State Tax Identification Number, enter here: _____________________________________

8.* For which tax registration are you applying? Check all that apply. Registrations with asterisk (**) require an additional application; see instructions for

details.

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

Sales and Use

Alcohol License**

Limousine Alcohol License**

Motor Fuel License**

Non-Resident Distribution

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

Withholding Tax

Tobacco License**

Lottery Retailer**

Amusement License**

Electronic Bulk Filer

g

f

e

d

c

g

f

e

d

c

Motor Carrier/IFTA

Contractor

SECTION 2 - Business Information

1.* Date of First Operation (mm/dd/yyyy)

2. Business Fiscal Year End

3.* Business Legal Name

4. Federal Employer Identification Number (FEIN)

5. Business Trade Name (DBA)

6.* Business Telephone Number

7.* Business Street Address (can not be a PO BOX)

City / Town

County

State

Zip

NOTE: To have correspondence and reporting forms mailed

to a different address, please complete line 8 and indicate the related tax type(s)

for each address. Use Form CRF-003 to list additional

addresses.

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

Sales and Use

Withholding

Amusement

Alcohol

Tobacco

Motor Fuel Distributor

8.*Business Mailing Address (if different from above)

City / Town

County

State

Zip

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

Alcohol

Tobacco

Motor Fuel Distributor

Sales and Use

Withholding

Amusement

City / Town

County

State

Zip

8.*Business Mailing Address (if different from above)

9. Which accounting method will your business use?

10.* If your business is seasonal, list months of operation. (mm - mm)

g

f

e

d

c

g

f

e

d

c

Accrual

Cash

11. Email:__________________________________________ 12. Fax: ________________________________________

SECTION 3 - Business Structure

Check the type of business structure your business represents. (You must select one of the following.)

g

f

e

d

c

Sole Proprietorship

g

f

e

d

c

Partnership

g

f

e

d

c

Corporation

/

State of Incorporation

Date of Incorporation

g

f

e

d

c

Sub-Chapter S Corporation

g

f

e

d

c

Limited Liability Corporation / Single

Multiple

g

f

e

d

c

Limited Liability Partnership

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

Fiduciary

Professional Association

Estate

Federal Agency

State Agency

County Government

Municipal

Government

CRF - 002 - Registration Application 1

1

1 2

2