Instructions For Form 1120-Ic-Disc - 2006

ADVERTISEMENT

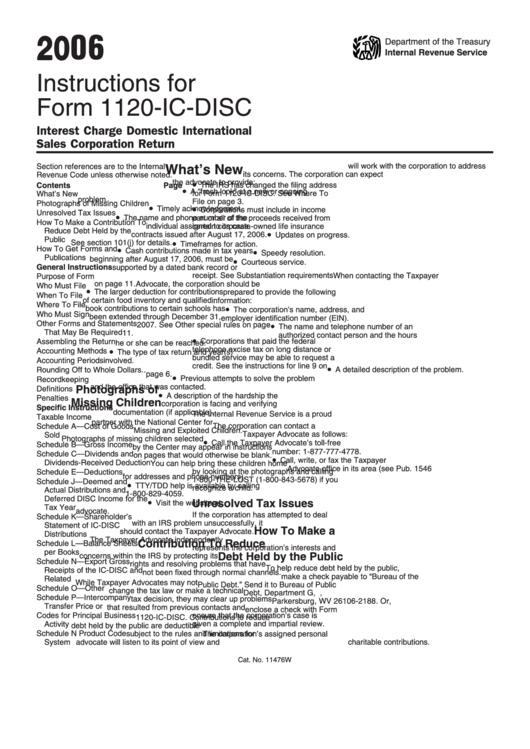

2006

Department of the Treasury

Internal Revenue Service

Instructions for

Form 1120-IC-DISC

Interest Charge Domestic International

Sales Corporation Return

will work with the corporation to address

Section references are to the Internal

What’s New

its concerns. The corporation can expect

Revenue Code unless otherwise noted.

•

the advocate to provide:

Contents

Page

The IRS has changed the filing address

•

A “fresh look” at a new or ongoing

for Form 1120-IC-DISC. See Where To

What’s New . . . . . . . . . . . . . . . . . . . . 1

problem.

File on page 3.

Photographs of Missing Children . . . . 1

•

•

Timely acknowledgment.

Corporations must include in income

Unresolved Tax Issues . . . . . . . . . . . . 1

•

part or all of the proceeds received from

The name and phone number of the

How To Make a Contribution To

certain corporate-owned life insurance

individual assigned to its case.

Reduce Debt Held by the

•

contracts issued after August 17, 2006.

Updates on progress.

Public . . . . . . . . . . . . . . . . . . . . . . 1

•

See section 101(j) for details.

Timeframes for action.

•

How To Get Forms and

•

Cash contributions made in tax years

Speedy resolution.

Publications . . . . . . . . . . . . . . . . . . 1

beginning after August 17, 2006, must be

•

Courteous service.

General Instructions . . . . . . . . . . . . . 2

supported by a dated bank record or

receipt. See Substantiation requirements

When contacting the Taxpayer

Purpose of Form . . . . . . . . . . . . . . . . 2

on page 11.

Advocate, the corporation should be

Who Must File . . . . . . . . . . . . . . . . . . 2

•

The larger deduction for contributions

prepared to provide the following

When To File . . . . . . . . . . . . . . . . . . . 2

of certain food inventory and qualified

information:

Where To File . . . . . . . . . . . . . . . . . . 3

•

book contributions to certain schools has

The corporation’s name, address, and

Who Must Sign . . . . . . . . . . . . . . . . . 3

been extended through December 31,

employer identification number (EIN).

Other Forms and Statements

•

2007. See Other special rules on page

The name and telephone number of an

That May Be Required . . . . . . . . . . 3

11.

authorized contact person and the hours

•

Corporations that paid the federal

Assembling the Return . . . . . . . . . . . . 3

he or she can be reached.

telephone excise tax on long distance or

•

Accounting Methods . . . . . . . . . . . . . . 3

The type of tax return and year(s)

bundled service may be able to request a

Accounting Periods . . . . . . . . . . . . . . 4

involved.

credit. See the instructions for line 9 on

•

A detailed description of the problem.

Rounding Off to Whole Dollars . . . . . . 4

page 6.

•

Previous attempts to solve the problem

Recordkeeping . . . . . . . . . . . . . . . . . . 4

and the office that was contacted.

Photographs of

Definitions . . . . . . . . . . . . . . . . . . . . . 4

•

A description of the hardship the

Penalties . . . . . . . . . . . . . . . . . . . . . . 5

Missing Children

corporation is facing and verifying

Specific Instructions . . . . . . . . . . . . 5

documentation (if applicable).

The Internal Revenue Service is a proud

Taxable Income . . . . . . . . . . . . . . . . . 6

partner with the National Center for

The corporation can contact a

Schedule A — Cost of Goods

Missing and Exploited Children.

Taxpayer Advocate as follows:

Sold . . . . . . . . . . . . . . . . . . . . . . . . 6

Photographs of missing children selected

•

Call the Taxpayer Advocate’s toll-free

Schedule B — Gross Income . . . . . . . . 7

by the Center may appear in instructions

number: 1-877-777-4778.

Schedule C — Dividends and

on pages that would otherwise be blank.

•

Call, write, or fax the Taxpayer

Dividends-Received Deduction . . . . 8

You can help bring these children home

Advocate office in its area (see Pub. 1546

by looking at the photographs and calling

Schedule E — Deductions . . . . . . . . . . 9

for addresses and phone numbers).

1-800-THE-LOST (1-800-843-5678) if you

Schedule J — Deemed and

•

TTY/TDD help is available by calling

recognize a child.

Actual Distributions and

1-800-829-4059.

Deferred DISC Income for the

•

Unresolved Tax Issues

Visit the website at

Tax Year . . . . . . . . . . . . . . . . . . . 12

advocate.

If the corporation has attempted to deal

Schedule K — Shareholder’s

with an IRS problem unsuccessfully, it

Statement of IC-DISC

How To Make a

should contact the Taxpayer Advocate.

Distributions . . . . . . . . . . . . . . . . . 13

The Taxpayer Advocate independently

Contribution To Reduce

Schedule L — Balance Sheets

represents the corporation’s interests and

per Books . . . . . . . . . . . . . . . . . . 13

Debt Held by the Public

concerns within the IRS by protecting its

Schedule N — Export Gross

rights and resolving problems that have

To help reduce debt held by the public,

Receipts of the IC-DISC and

not been fixed through normal channels.

make a check payable to “Bureau of the

Related U.S. Persons . . . . . . . . . . 14

While Taxpayer Advocates may not

Public Debt.” Send it to Bureau of Public

Schedule O — Other Information

. . . 14

change the tax law or make a technical

Debt, Department G, P.O. Box 2188,

Schedule P — Intercompany

tax decision, they may clear up problems

Parkersburg, WV 26106-2188. Or,

Transfer Price or Commission

. . . 14

that resulted from previous contacts and

enclose a check with Form

Codes for Principal Business

ensure that the corporation’s case is

1120-IC-DISC. Contributions to reduce

given a complete and impartial review.

Activity . . . . . . . . . . . . . . . . . . . . . 15

debt held by the public are deductible

Schedule N Product Code

The corporation’s assigned personal

subject to the rules and limitations for

System . . . . . . . . . . . . . . . . . . . . 16

advocate will listen to its point of view and

charitable contributions.

Cat. No. 11476W

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16