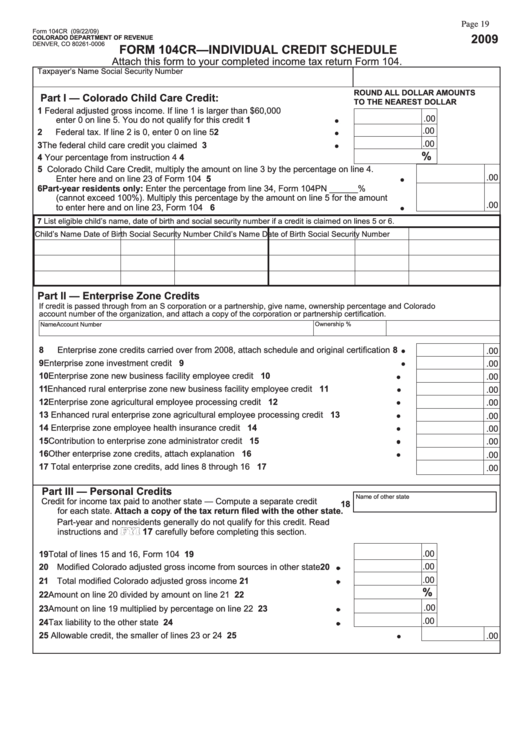

Form 104cr - Individual Credit Schedule - 2009

ADVERTISEMENT

Page 19

Form 104CR (09/22/09)

2009

COLORADO DEPARTMENT OF REVENUE

DENVER, CO 80261-0006

FORM 104CR—INDIVIDUAL CREDIT SCHEDULE

Attach this form to your completed income tax return Form 104.

Taxpayer’s Name

Social Security Number

ROUND ALL DOLLAR AMOUNTS

Part I — Colorado Child Care Credit:

TO THE NEAREST DOLLAR

1

Federal adjusted gross income. If line 1 is larger than $60,000

.00

enter 0 on line 5. You do not qualify for this credit .....................................

1

.00

2

Federal tax. If line 2 is 0, enter 0 on line 5 .................................................

2

.00

3

The federal child care credit you claimed ..................................................

3

%

4

Your percentage from instruction 4 .............................................................. 4

5

Colorado Child Care Credit, multiply the amount on line 3 by the percentage on line 4.

.00

Enter here and on line 23 of Form 104 .................................................................................. 5

6

Part-year residents only: Enter the percentage from line 34, Form 104PN ______%

(cannot exceed 100%). Multiply this percentage by the amount on line 5 for the amount

.00

to enter here and on line 23, Form 104 .................................................................................. 6

7 List eligible child’s name, date of birth and social security number if a credit is claimed on lines 5 or 6.

Child’s Name

Date of Birth

Social Security Number

Child’s Name

Date of Birth

Social Security Number

Part II — Enterprise Zone Credits

If credit is passed through from an S corporation or a partnership, give name, ownership percentage and Colorado

account number of the organization, and attach a copy of the corporation or partnership certification.

Ownership %

Name

Account Number

8

Enterprise zone credits carried over from 2008, attach schedule and original certification .... 8

.00

9

Enterprise zone investment credit .......................................................................................... 9

.00

10 Enterprise zone new business facility employee credit ........................................................ 10

.00

11 Enhanced rural enterprise zone new business facility employee credit ............................... 11

.00

12 Enterprise zone agricultural employee processing credit .................................................... 12

.00

13 Enhanced rural enterprise zone agricultural employee processing credit ........................... 13

.00

14 Enterprise zone employee health insurance credit .............................................................. 14

.00

15 Contribution to enterprise zone administrator credit ............................................................ 15

.00

16 Other enterprise zone credits, attach explanation ............................................................... 16

.00

17 Total enterprise zone credits, add lines 8 through 16 ........................................................... 17

.00

Part III — Personal Credits

Name of other state

Credit for income tax paid to another state — Compute a separate credit

18

for each state. Attach a copy of the tax return filed with the other state.

Part-year and nonresidents generally do not qualify for this credit. Read

FYI

17 carefully before completing this section.

instructions and

.00

19 Total of lines 15 and 16, Form 104 ............................................................... 19

.00

20 Modified Colorado adjusted gross income from sources in other state ..... 20

.00

21 Total modified Colorado adjusted gross income ........................................ 21

%

22 Amount on line 20 divided by amount on line 21 ......................................... 22

.00

23 Amount on line 19 multiplied by percentage on line 22 ............................. 23

.00

24 Tax liability to the other state ...................................................................... 24

25 Allowable credit, the smaller of lines 23 or 24 ...................................................................... 25

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2