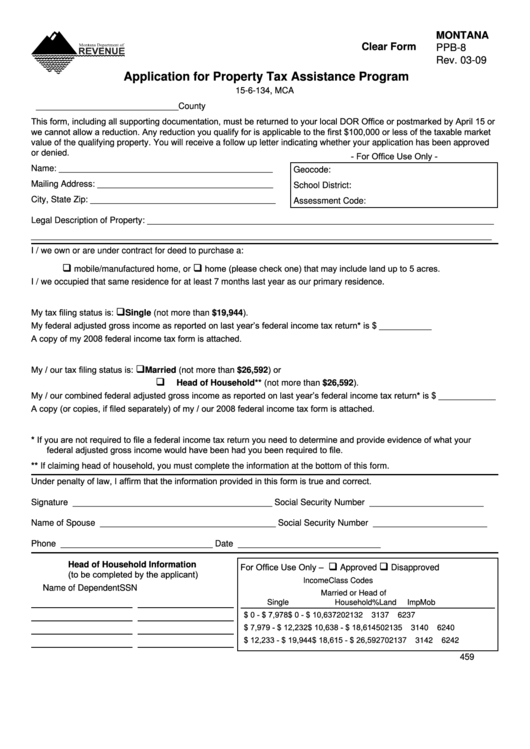

MONTANA

Clear Form

PPB-8

Rev. 03-09

Application for Property Tax Assistance Program

15-6-134, MCA

______________________________ County

This form, including all supporting documentation, must be returned to your local DOR Office or postmarked by April 15 or

we cannot allow a reduction. Any reduction you qualify for is applicable to the first $100,000 or less of the taxable market

value of the qualifying property. You will receive a follow up letter indicating whether your application has been approved

or denied.

- For Office Use Only -

Name: _____________________________________________

Geocode:

Mailing Address: _____________________________________

School District:

City, State Zip: _______________________________________

Assessment Code:

Legal Description of Property: _________________________________________________________________________

_________________________________________________________________________________________________

I / we own or are under contract for deed to purchase a:

q

q

home (please check one) that may include land up to 5 acres.

mobile/manufactured home, or

I / we occupied that same residence for at least 7 months last year as our primary residence.

q

My tax filing status is:

Single (not more than $19,944).

My federal adjusted gross income as reported on last year’s federal income tax return* is $ ___________

A copy of my 2008 federal income tax form is attached.

q

My / our tax filing status is:

Married (not more than $26,592) or

q

Head of Household** (not more than $26,592).

My / our combined federal adjusted gross income as reported on last year’s federal income tax return* is $ ____________

A copy (or copies, if filed separately) of my / our 2008 federal income tax form is attached.

If you are not required to file a federal income tax return you need to determine and provide evidence of what your

*

federal adjusted gross income would have been had you been required to file.

** If claiming head of household, you must complete the information at the bottom of this form.

Under penalty of law, I affirm that the information provided in this form is true and correct.

Signature __________________________________________

Social Security Number ________________________

Name of Spouse _____________________________________

Social Security Number ________________________

Phone ________________________________

Date ______________________________

Head of Household Information

q

q

For Office Use Only –

Approved

Disapproved

(to be completed by the applicant)

Income

Class Codes

Name of Dependent

SSN

Married or Head of

Single

Household

%

Land

Imp

Mob

$

0 - $ 7,978 $

0 - $ 10,637

20

2132

3137

6237

$ 7,979 - $ 12,232 $ 10,638 - $ 18,614

50

2135

3140

6240

$ 12,233 - $ 19,944 $ 18,615 - $ 26,592

70

2137

3142

6242

459

1

1