Form Mw3/ar - State Income Tax Withholding (W-2) Transmittal Document And Reconciliation For Annual Remitters - 2001

ADVERTISEMENT

Compliance, Valuation & Resolution

P. O. Box 5805

Sam W. Mitchell Building

Helena, Montana 59604-5805

Transaction Id:

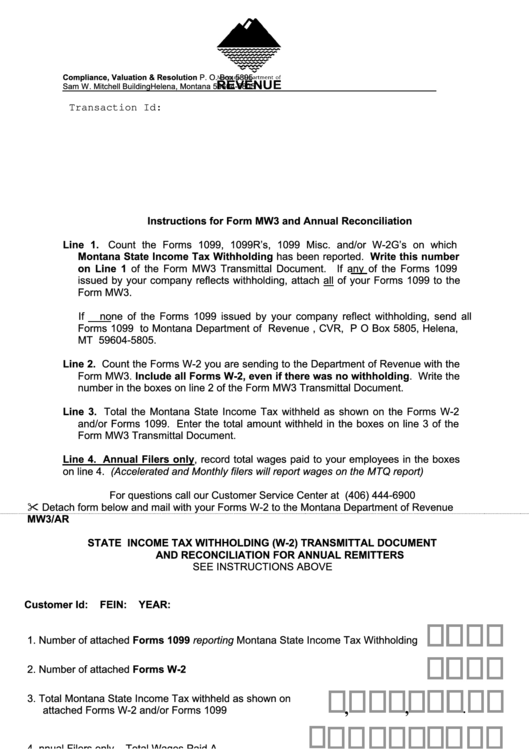

Instructions for Form MW3 and Annual Reconciliation

Line 1.

Count the Forms 1099, 1099R’s, 1099 Misc. and/or W-2G’s on which

Montana State Income Tax Withholding has been reported. Write this number

on Line 1 of the Form MW3 Transmittal Document.

If any of the Forms 1099

issued by your company reflects withholding, attach all of your Forms 1099 to the

Form MW3.

If none of the Forms 1099 issued by your company reflect withholding, send all

Forms 1099 to Montana Department of Revenue , CVR, P O Box 5805, Helena,

MT 59604-5805.

Line 2. Count the Forms W-2 you are sending to the Department of Revenue with the

Form MW3. Include all Forms W-2, even if there was no withholding. Write the

number in the boxes on line 2 of the Form MW3 Transmittal Document.

Line 3. Total the Montana State Income Tax withheld as shown on the Forms W-2

and/or Forms 1099. Enter the total amount withheld in the boxes on line 3 of the

Form MW3 Transmittal Document.

Line 4. Annual Filers only, record total wages paid to your employees in the boxes

on line 4. (Accelerated and Monthly filers will report wages on the MTQ report)

For questions call our Customer Service Center at (406) 444-6900

Detach form below and mail with your Forms W-2 to the Montana Department of Revenue

MW3/AR

STATE INCOME TAX WITHHOLDING (W-2) TRANSMITTAL DOCUMENT

AND RECONCILIATION FOR ANNUAL REMITTERS

SEE INSTRUCTIONS ABOVE

Customer Id:

FEIN:

YEAR:

1. Number of attached Forms 1099 reporting Montana State Income Tax Withholding

2. Number of attached Forms W-2

3. Total Montana State Income Tax withheld as shown on

,

.

,

attached Forms W-2 and/or Forms 1099

4.

A

nnual Filers only – Total Wages Paid

,

,

.

Name, title and phone number of Contact Person

DEPARTMENT OF REVENUE

_____________________________________________________

PO BOX

6339

HELENA, MT 59604-6339

_____________________________________________________

_____________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1