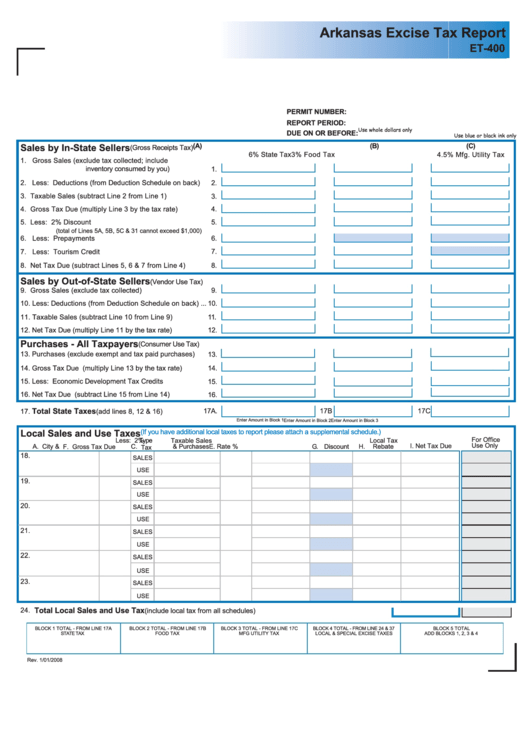

Et-400 - Arkansas Excise Tax Report Form January 2008

ADVERTISEMENT

Arkansas Excise Tax Report

ET-400

PERMIT NUMBER:

REPORT PERIOD:

Use whole dollars only

DUE ON OR BEFORE:

Use blue or black ink only

(A)

(B)

(C)

Sales by In-State Sellers

(Gross Receipts Tax)

6% State Tax

3% Food Tax

4.5% Mfg. Utility Tax

1. Gross Sales (exclude tax collected; include

inventory consumed by you) ......................

1.

2. Less: Deductions (from Deduction Schedule on back).....

2.

3. Taxable Sales (subtract Line 2 from Line 1) ....................

3.

4. Gross Tax Due (multiply Line 3 by the tax rate) ..............

4.

5. Less: 2% Discount ........................................................

5.

(total of Lines 5A, 5B, 5C & 31 cannot exceed $1,000)

6. Less: Prepayments .......................................................

6.

7. Less: Tourism Credit .....................................................

7.

8. Net Tax Due (subtract Lines 5, 6 & 7 from Line 4)...........

8.

Sales by Out-of-State Sellers

(Vendor Use Tax)

9. Gross Sales (exclude tax collected) ................................

9.

10. Less: Deductions (from Deduction Schedule on back) ...

10.

11. Taxable Sales (subtract Line 10 from Line 9) .................

11.

12. Net Tax Due (multiply Line 11 by the tax rate) .................

12.

Purchases - All Taxpayers

(Consumer Use Tax)

13. Purchases (exclude exempt and tax paid purchases) .....

13.

14. Gross Tax Due (multiply Line 13 by the tax rate) .............

14.

15. Less: Economic Development Tax Credits ......................

15.

16. Net Tax Due (subtract Line 15 from Line 14) ...................

16.

Total State Taxes

17A.

17B

17C

17.

(add lines 8, 12 & 16) ...................

Enter Amount in Block 1

Enter Amount in Block 2

Enter Amount in Block 3

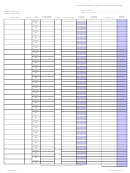

Local Sales and Use Taxes

(If you have additional local taxes to report please attach a supplemental schedule.)

For Office

Type

Taxable Sales

Less: 2%

Local Tax

Use Only

I. Net Tax Due

A. City & County

B. Code

C.

D.

& Purchases

E. Rate %

F. Gross Tax Due

G.

Discount

H.

Rebate

Tax

18.

SALES

USE

19.

SALES

USE

20.

SALES

USE

21.

SALES

USE

22.

SALES

USE

23.

SALES

USE

Total Local Sales and Use Tax

24.

(include local tax from all schedules) ......................................................................

BLOCK 1 TOTAL - FROM LINE 17A

BLOCK 2 TOTAL - FROM LINE 17B

BLOCK 3 TOTAL - FROM LINE 17C

BLOCK 4 TOTAL - FROM LINE 24 & 37

BLOCK 5 TOTAL

STATE TAX

FOOD TAX

MFG UTILITY TAX

LOCAL & SPECIAL EXCISE TAXES

ADD BLOCKS 1, 2, 3 & 4

Rev. 1/01/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3