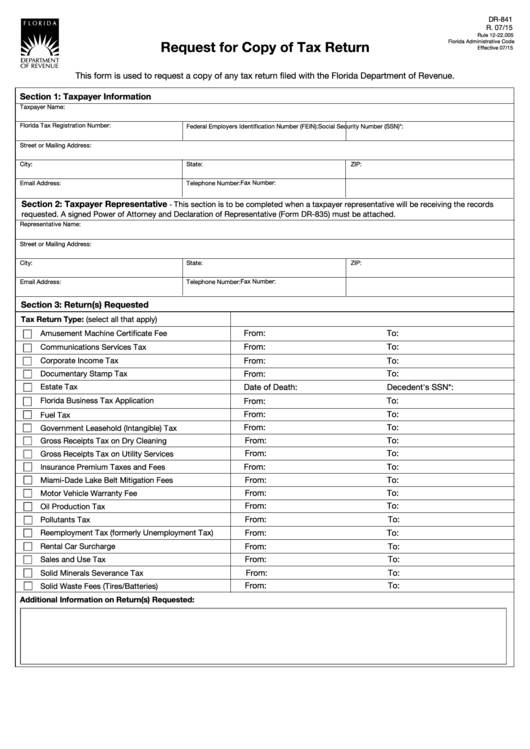

DR-841

R. 07/15

Rule 12-22.005

Request for Copy of Tax Return

Florida Administrative Code

Effective 07/15

This form is used to request a copy of any tax return filed with the Florida Department of Revenue.

Section 1: Taxpayer Information

Taxpayer Name:

Florida Tax Registration Number:

Federal Employers Identification Number (FEIN):

Social Security Number (SSN)*:

Street or Mailing Address:

City:

State:

ZIP:

Email Address:

Telephone Number:

Fax Number:

Section 2: Taxpayer Representative

This section is to be completed when a taxpayer representative will be receiving the records

-

requested. A signed Power of Attorney and Declaration of Representative (Form DR-835) must be attached.

Representative Name:

Street or Mailing Address:

City:

ZIP:

State:

Email Address:

Fax Number:

Telephone Number:

Section 3: Return(s) Requested

Tax Return Type: (select all that apply)

Amusement Machine Certificate Fee

From:

To:

From:

To:

Communications Services Tax

Corporate Income Tax

From:

To:

To:

Documentary Stamp Tax

From:

Estate Tax

Date of Death:

Decedent's SSN*:

Florida Business Tax Application

To:

From:

From:

To:

Fuel Tax

To:

From:

Government Leasehold (Intangible) Tax

From:

To:

Gross Receipts Tax on Dry Cleaning

From:

To:

Gross Receipts Tax on Utility Services

Insurance Premium Taxes and Fees

From:

To:

Miami-Dade Lake Belt Mitigation Fees

From:

To:

From:

To:

Motor Vehicle Warranty Fee

To:

From:

Oil Production Tax

From:

To:

Pollutants Tax

Reemployment Tax (formerly Unemployment Tax)

From:

To:

Rental Car Surcharge

From:

To:

Sales and Use Tax

From:

To:

Solid Minerals Severance Tax

From:

To:

From:

To:

Solid Waste Fees (Tires/Batteries)

Additional Information on Return(s) Requested:

1

1 2

2