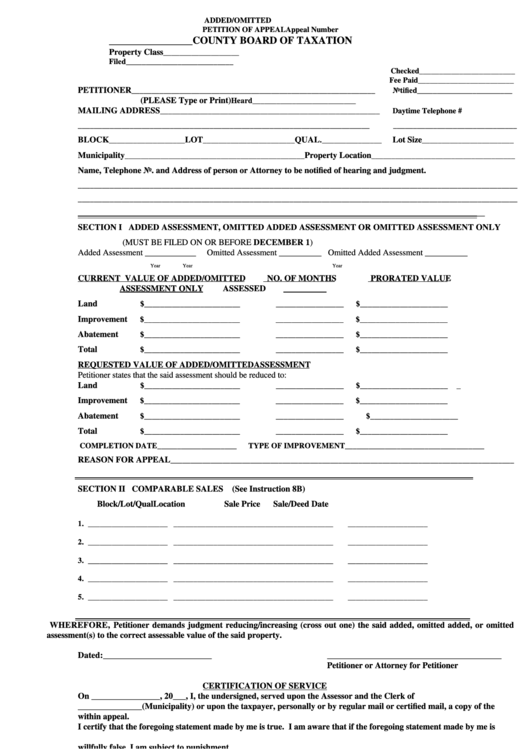

ADDED/OMITTED

PETITION OF APPEAL

Appeal Number

________________COUNTY BOARD OF TAXATION

Property Class

___________________

Filed___________________________

Checked________________________

Fee Paid________________________

PETITIONER

_____________________________________________________________

Notified________________________

(PLEASE Type or Print)

Heard__________________________

MAILING ADDRESS

_______________________________________________________

Daytime Telephone #

_________________________________________________________________________

_______________________________

BLOCK

LOT

QUAL

Lot Size

___________________

_______________________

._______________

_______________________

Municipality

Property Location

_____________________________________________

____________________________________

Name, Telephone No. and Address of person or Attorney to be notified of hearing and judgment.

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

____

SECTION I ADDED ASSESSMENT, OMITTED ADDED ASSESSMENT OR OMITTED ASSESSMENT ONLY

(MUST BE FILED ON OR BEFORE DECEMBER 1)

Added Assessment ____________

Omitted Assessment __________ Omitted Added Assessment __________

Year

Year

Year

CURRENT VALUE OF ADDED/OMITTED

NO. OF MONTHS

PRORATED VALUE

ASSESSMENT ONLY

ASSESSED

Land

$________________________

_________________

$______________________

Improvement

$________________________

_________________

$______________________

Abatement

$________________________

_________________

$______________________

Total

$________________________

_________________

$______________________

REQUESTED VALUE OF ADDED/OMITTEDASSESSMENT

Petitioner states that the said assessment should be reduced to:

Land

$________________________

_________________

$______________________

Improvement

$________________________

_________________

$______________________

Abatement

$________________________

_________________

$______________________

Total

$________________________

_________________

$______________________

COMPLETION DATE____________________

TYPE OF IMPROVEMENT___________________________________

REASON FOR APPEAL

______________________________________________________________________________________

SECTION II COMPARABLE SALES (See Instruction 8B)

Block/Lot/Qual

Location

Sale Price

Sale/Deed Date

1. ____________________

____________________

____________________

____________________

2. ____________________

____________________

____________________

____________________

3. ____________________

____________________

____________________

____________________

4. ____________________

____________________

____________________

____________________

5. ____________________

____________________

____________________

____________________

WHEREFORE, Petitioner demands judgment reducing/increasing (cross out one) the said added, omitted added, or omitted

assessment(s) to the correct assessable value of the said property.

Dated:_________________________

________________________________________

Petitioner or Attorney for Petitioner

CERTIFICATION OF SERVICE

On ________________, 20___, I, the undersigned, served upon the Assessor and the Clerk of

_______________(Municipality) or upon the taxpayer, personally or by regular mail or certified mail, a copy of the

within appeal.

I certify that the foregoing statement made by me is true. I am aware that if the foregoing statement made by me is

willfully false, I am subject to punishment.

Date:____________________________

Signed:________________________________________________

This form has been prescribed by the New Jersey Division of Taxation. No other form will be

accepted. Reproduction of this form is permitted provided it is of the same size and texture.

1

1 2

2 3

3