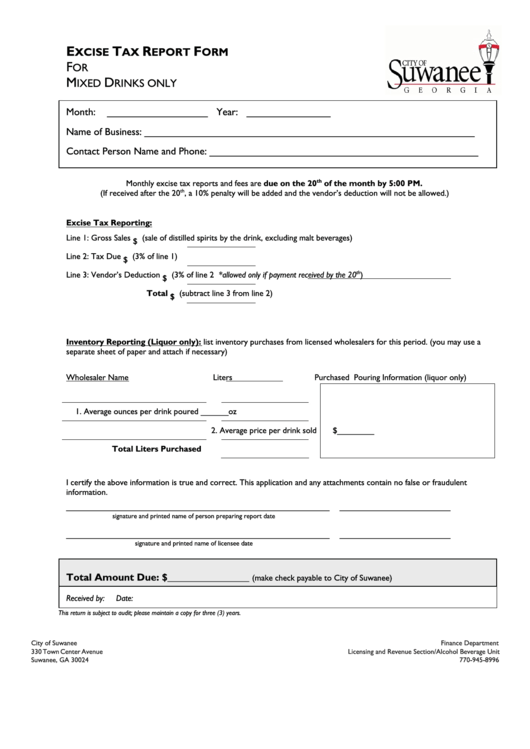

Excise Tax Report Form

ADVERTISEMENT

E

T

R

F

XCISE

AX

EPORT

ORM

F

OR

M

D

IXED

RINKS ONLY

Month:

__________________

Year: _______________

Name of Business: ___________________________________________________________

Contact Person Name and Phone: ________________________________________________

Monthly excise tax reports and fees are due on the 20

th

of the month by 5:00 PM.

(If received after the 20

th

, a 10% penalty will be added and the vendor’s deduction will not be allowed.)

Excise Tax Reporting:

Line 1: Gross Sales

(sale of distilled spirits by the drink, excluding malt beverages)

$

Line 2: Tax Due

(3% of line 1)

$

Line 3: Vendor’s Deduction

(3% of line 2 *allowed only if payment received by the 20

th

)

$

Total

(subtract line 3 from line 2)

$

Inventory Reporting (Liquor only): list inventory purchases from licensed wholesalers for this period. (you may use a

separate sheet of paper and attach if necessary)

Wholesaler Name

Liters Purchased

Pouring Information (liquor only)

1. Average ounces per drink poured ______oz

2. Average price per drink sold

$________

Total Liters Purchased

I certify the above information is true and correct. This application and any attachments contain no false or fraudulent

information.

_________________________________________________________

________________________

signature and printed name of person preparing report

date

_________________________________________________________

________________________

signature and printed name of licensee

date

Total Amount Due: $________________

(make check payable to City of Suwanee)

Received by:

Date:

This return is subject to audit; please maintain a copy for three (3) years.

City of Suwanee

Finance Department

330 Town Center Avenue

Licensing and Revenue Section/Alcohol Beverage Unit

Suwanee, GA 30024

770-945-8996

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1