RESET

Department of Revenue Services

State of Connecticut

(Rev. 02/08)

Municipality: ____________________

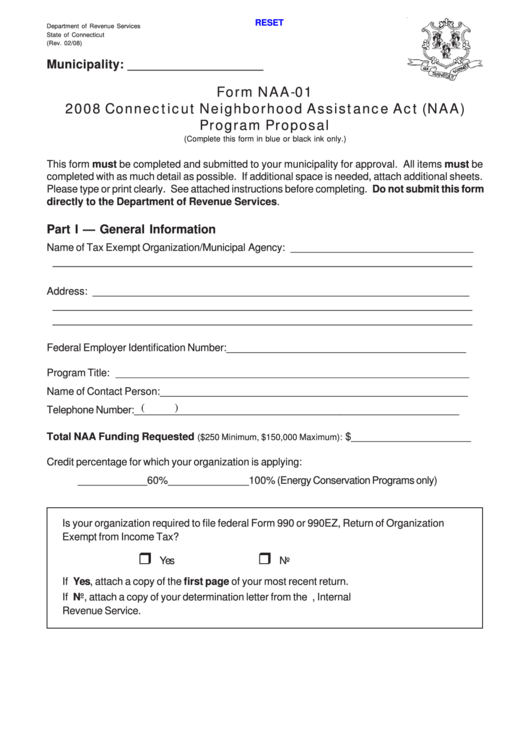

Form NAA-01

2008 Connecticut Neighborhood Assistance Act (NAA)

Program Proposal

(Complete this form in blue or black ink only.)

This form must be completed and submitted to your municipality for approval. All items must be

completed with as much detail as possible. If additional space is needed, attach additional sheets.

Please type or print clearly. See attached instructions before completing. Do not submit this form

directly to the Department of Revenue Services.

Part I — General Information

Name of Tax Exempt Organization/Municipal Agency: ________________________________

_____________________________________________________________________

Address: __________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

Federal Employer Identification Number: __________________________________________

Program Title: ______________________________________________________________

Name of Contact Person: ______________________________________________________

(

)

Telephone Number: __________________________________________________________

Total NAA Funding Requested

$ _____________________

($250 Minimum, $150,000 Maximum):

Credit percentage for which your organization is applying:

____________60%

______________100% (Energy Conservation Programs only)

Is your organization required to file federal Form 990 or 990EZ, Return of Organization

Exempt from Income Tax?

Yes

No

If Yes, attach a copy of the first page of your most recent return.

If No, attach a copy of your determination letter from the U.S. Treasury Department, Internal

Revenue Service.

1

1 2

2 3

3 4

4 5

5