*0612830120C*

■ ■

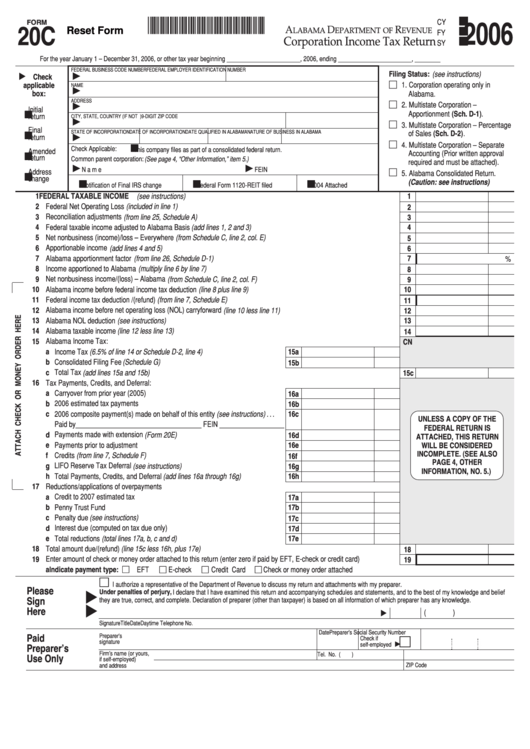

CY

FORM

2006

■ ■

A

D

R

Reset Form

20C

LABAMA

EPARTMENT OF

EVENUE

FY

■ ■

Corporation Income Tax Return

SY

For the year January 1 – December 31, 2006, or other tax year beginning _______________________, 2006, ending _______________________, ________

FEDERAL BUSINESS CODE NUMBER

FEDERAL EMPLOYER IDENTIFICATION NUMBER

Filing Status: (see instructions)

Check

1. Corporation operating only in

applicable

NAME

Alabama.

box:

ADDRESS

2. Multistate Corporation –

Initial

■ ■

Apportionment (Sch. D-1).

return

CITY, STATE, COUNTRY (IF NOT U.S.)

9-DIGIT ZIP CODE

3. Multistate Corporation – Percentage

Final

■ ■

STATE OF INCORPORATION

DATE OF INCORPORATION

DATE QUALIFIED IN ALABAMA

NATURE OF BUSINESS IN ALABAMA

of Sales (Sch. D-2).

return

■ ■

4. Multistate Corporation – Separate

Check Applicable:

This company files as part of a consolidated federal return.

Amended

■ ■

Accounting (Prior written approval

return

Common parent corporation: (See page 4, “Other Information,” item 5.)

required and must be attached).

Name

FEIN

Address

■ ■

5. Alabama Consolidated Return.

change

■ ■

■ ■

■ ■

(Caution: see instructions)

Notification of Final IRS change

Federal Form 1120-REIT filed

7004 Attached

1 FEDERAL TAXABLE INCOME (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Federal Net Operating Loss (included in line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Reconciliation adjustments (from line 25, Schedule A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Federal taxable income adjusted to Alabama Basis (add lines 1, 2 and 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Net nonbusiness (income)/loss – Everywhere (from Schedule C, line 2, col. E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Apportionable income (add lines 4 and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Alabama apportionment factor (from line 26, Schedule D-1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

%

8 Income apportioned to Alabama (multiply line 6 by line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Net nonbusiness income/(loss) – Alabama (from Schedule C, line 2, col. F) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Alabama income before federal income tax deduction (line 8 plus line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Federal income tax deduction /(refund) (from line 7, Schedule E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Alabama income before net operating loss (NOL) carryforward (line 10 less line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Alabama NOL deduction (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Alabama taxable income (line 12 less line 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Alabama Income Tax:

CN

a Income Tax (6.5% of line 14 or Schedule D-2, line 4) . . . . . . . . . . . . . . . . . . . . . . . . .

15a

b Consolidated Filing Fee (Schedule G) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15b

c Total Tax (add lines 15a and 15b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15c

16 Tax Payments, Credits, and Deferral:

a Carryover from prior year (2005) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16a

b 2006 estimated tax payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16b

c 2006 composite payment(s) made on behalf of this entity (see instructions) . . .

16c

UNLESS A COPY OF THE

Paid by___________________________________ FEIN __________________

FEDERAL RETURN IS

d Payments made with extension (Form 20E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16d

ATTACHED, THIS RETURN

e Payments prior to adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

WILL BE CONSIDERED

16e

INCOMPLETE. (SEE ALSO

f Credits (from line 7, Schedule F) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16f

PAGE 4, OTHER

g LIFO Reserve Tax Deferral (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16g

INFORMATION, NO. 5.)

h Total Payments, Credits, and Deferral (add lines 16a through 16g) . . . . . . . . . . .

16h

17 Reductions/applications of overpayments

a Credit to 2007 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17a

b Penny Trust Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17b

c Penalty due (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17c

d Interest due (computed on tax due only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17d

e Total reductions (total lines 17a, b, c and d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17e

18 Total amount due/(refund) (line 15c less 16h, plus 17e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19 Enter amount of check or money order attached to this return (enter zero if paid by EFT, E-check or credit card). . . . . . . . . .

19

a Indicate payment type:

EFT

E-check

Credit Card

Check or money order attached

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Please

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief

Sign

they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Here

(

)

Signature

Title

Date

Daytime Telephone No.

Date

Preparer’s Social Security Number

Preparer’s

Paid

Check if

signature

self-employed

Preparer’s

Firm’s name (or yours,

Tel. No. (

)

E.I. No.

Use Only

if self-employed)

ZIP Code

and address

1

1 2

2 3

3 4

4