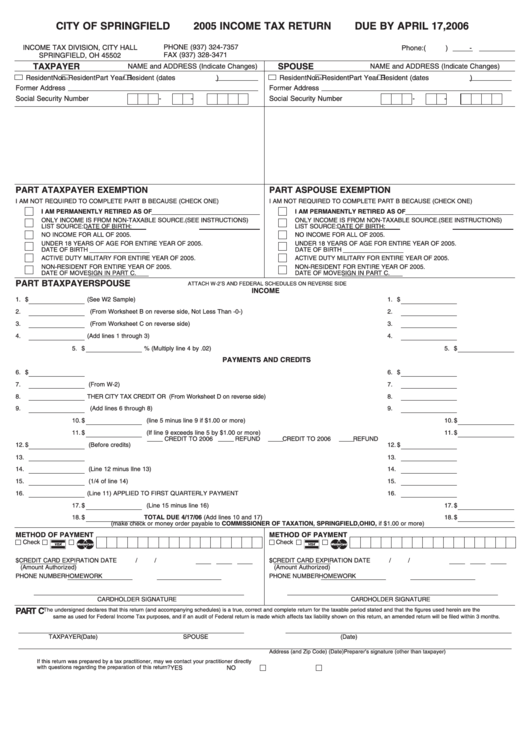

Income Tax Return Form - Springfield Income Tax Division - 2005

ADVERTISEMENT

CITY OF SPRINGFIELD

2005 INCOME TAX RETURN

DUE BY APRIL 17, 2006

PHONE (937) 324-7357

INCOME TAX DIVISION, CITY HALL

Phone: (

)

-

FAX (937) 328-3471

SPRINGFIELD, OH 45502

TAXPAYER

SPOUSE

NAME and ADDRESS (Indicate Changes)

NAME and ADDRESS (Indicate Changes)

Resident

Non-Resident

Part Year Resident (dates

)

Resident

Non-Resident

Part Year Resident (dates

)

Former Address

Former Address

Social Security Number

-

-

Social Security Number

-

-

PART A

TAXPAYER EXEMPTION

PART A

SPOUSE EXEMPTION

I AM NOT REQUIRED TO COMPLETE PART B BECAUSE (CHECK ONE)

I AM NOT REQUIRED TO COMPLETE PART B BECAUSE (CHECK ONE)

I AM PERMANENTLY RETIRED AS OF

I AM PERMANENTLY RETIRED AS OF

ONLY INCOME IS FROM NON-TAXABLE SOURCE. (SEE INSTRUCTIONS)

ONLY INCOME IS FROM NON-TAXABLE SOURCE. (SEE INSTRUCTIONS)

LIST SOURCE:

DATE OF BIRTH:

LIST SOURCE:

DATE OF BIRTH:

NO INCOME FOR ALL OF 2005.

NO INCOME FOR ALL OF 2005.

UNDER 18 YEARS OF AGE FOR ENTIRE YEAR OF 2005.

UNDER 18 YEARS OF AGE FOR ENTIRE YEAR OF 2005.

DATE OF BIRTH

DATE OF BIRTH

ACTIVE DUTY MILITARY FOR ENTIRE YEAR OF 2005.

ACTIVE DUTY MILITARY FOR ENTIRE YEAR OF 2005.

NON-RESIDENT FOR ENTIRE YEAR OF 2005.

NON-RESIDENT FOR ENTIRE YEAR OF 2005.

DATE OF MOVE

SIGN IN PART C.

DATE OF MOVE

SIGN IN PART C.

PART B

TAXPAYER

SPOUSE

ATTACH W-2’S AND FEDERAL SCHEDULES ON REVERSE SIDE

INCOME

1. $

............................................................TOTAL WAGES AND COMPENSATION (See W2 Sample) ......................

1. $

2.

........................................TOTAL OTHER INCOME (From Worksheet B on reverse side, Not Less Than -0-) ....

2.

3.

..........................................................NET ADJUSTMENTS (From Worksheet C on reverse side) ......................

3.

4.

..................................................................TOTAL TAXABLE INCOME (Add lines 1 through 3) ............................

4.

5. $

..............................SPRINGFIELD CITY TAX - 2% (Multiply line 4 by .02) ............................................................

5. $

PAYMENTS AND CREDITS

6. $

....................................................ESTIMATED PAYMENTS / PRIOR YEAR OVERPAYMENT CREDIT................

6. $

7.

......................................................................WITHHELD FOR SPRINGFIELD (From W-2)..................................

7.

8.

....................................OTHER CITY TAX CREDIT OR J.E.D.D. TAX CREDIT (From Worksheet D on reverse side)

8.

9.

..........................................................TOTAL PAYMENTS AND CREDITS (Add lines 6 through 8) ......................

9.

10. $

......................BALANCE OF TAX DUE (line 5 minus line 9 if $1.00 or more) ......................................................

10. $

11. $

........................OVERPAYMENT (If line 9 exceeds line 5 by $1.00 or more) ........................................................

11. $

CREDIT TO 2006

REFUND

CREDIT TO 2006

REFUND

12. $

................................................................TOTAL 2006 ESTIMATED TAX DUE (Before credits) ............................

12. $

13.

............................................................................LESS CREDIT FOR TAX WITHHELD........................................

13.

14.

............................................................NET 2006 ESTIMATED TAX DUE (Line 12 minus lIne 13)........................

14.

15.

......................................................................QUARTERLY AMOUNT DUE (1/4 of line 14) ..................................

15.

16.

............................................PRIOR YEAR CREDIT (Line 11) APPLIED TO FIRST QUARTERLY PAYMENT ......

16.

17. $

..........BALANCE OF QUARTERLY PAYMENT DUE 4/17/06 (Line 15 minus line 16) ..........................................

17. $

18. $

......................................TOTAL DUE 4/17/06 (Add lines 10 and 17) ....................................................................

18. $

(make check or money order payable to COMMISSIONER OF TAXATION, SPRINGFIELD, OHIO, if $1.00 or more)

METHOD OF PAYMENT

METHOD OF PAYMENT

Check

Check

R

R

$

CREDIT CARD EXPIRATION DATE

/

/

$

CREDIT CARD EXPIRATION DATE

/

/

(Amount Authorized)

(Amount Authorized)

PHONE NUMBER

HOME

WORK

PHONE NUMBER

HOME

WORK

CARDHOLDER SIGNATURE

CARDHOLDER SIGNATURE

PART C

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are the

same as used for Federal Income Tax purposes, and if an audit of Federal return is made which affects tax liability shown on this return, an amended return will be filed within 3 months.

TAXPAYER

(Date)

SPOUSE

(Date)

Preparer’s signature (other than taxpayer)

(Date)

Address (and Zip Code)

F.E.I.N. or Soc. Sec. No.

If this return was prepared by a tax practitioner, may we contact your practitioner directly

with questions regarding the preparation of this return?

YES

NO

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2