Instructions For Form Ef-3 - 2011

ADVERTISEMENT

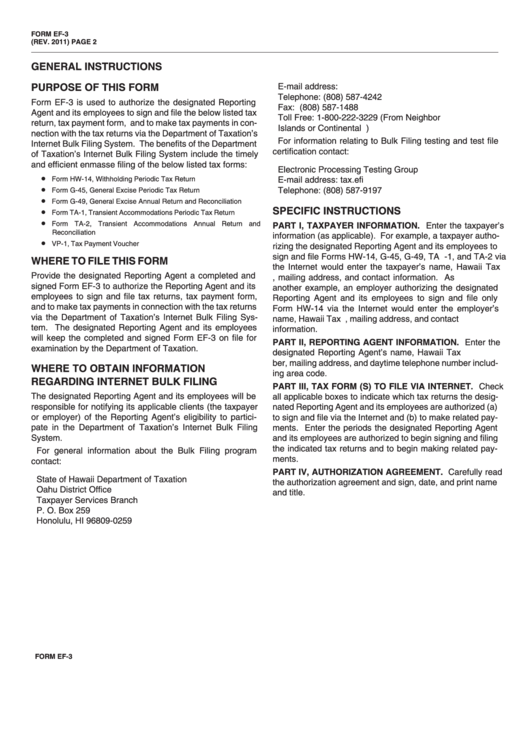

FORM EF-3

(REV. 2011)

PAGE 2

GENERAL INSTRUCTIONS

PURPOSE OF THIS FORM

E-mail address: Taxpayer.Services@hawaii.gov

Telephone:

(808) 587-4242

Form EF-3 is used to authorize the designated Reporting

Fax:

(808) 587-1488

Agent and its employees to sign and file the below listed tax

Toll Free:

1-800-222-3229 (From Neighbor

return, tax payment form, and to make tax payments in con-

Islands or Continental U.S.)

nection with the tax returns via the Department of Taxation’s

For information relating to Bulk Filing testing and test file

Internet Bulk Filing System. The benefits of the Department

certification contact:

of Taxation’s Internet Bulk Filing System include the timely

and efficient enmasse filing of the below listed tax forms:

Electronic Processing Testing Group

•

Form HW-14, Withholding Periodic Tax Return

E-mail address: tax.efile.test.bulk@hawaii.gov

•

Telephone:

(808) 587-9197

Form G-45, General Excise Periodic Tax Return

•

Form G-49, General Excise Annual Return and Reconciliation

SPECIFIC INSTRUCTIONS

•

Form TA-1, Transient Accommodations Periodic Tax Return

•

Form TA-2, Transient Accommodations Annual Return and

PART I, TAXPAYER INFORMATION. Enter the taxpayer’s

Reconciliation

information (as applicable). For example, a taxpayer autho-

•

VP-1, Tax Payment Voucher

rizing the designated Reporting Agent and its employees to

sign and file Forms HW-14, G-45, G-49, TA -1, and TA-2 via

WHERE TO FILE THIS FORM

the Internet would enter the taxpayer’s name, Hawaii Tax

Provide the designated Reporting Agent a completed and

I.D. number, mailing address, and contact information. As

signed Form EF-3 to authorize the Reporting Agent and its

another example, an employer authorizing the designated

employees to sign and file tax returns, tax payment form,

Reporting Agent and its employees to sign and file only

and to make tax payments in connection with the tax returns

Form HW-14 via the Internet would enter the employer’s

via the Department of Taxation’s Internet Bulk Filing Sys-

name, Hawaii Tax I.D. number, mailing address, and contact

tem. The designated Reporting Agent and its employees

information.

will keep the completed and signed Form EF-3 on file for

PART II, REPORTING AGENT INFORMATION. Enter the

examination by the Department of Taxation.

designated Reporting Agent’s name, Hawaii Tax I.D. num-

ber, mailing address, and daytime telephone number includ-

WHERE TO OBTAIN INFORMATION

ing area code.

REGARDING INTERNET BULK FILING

PART III, TAX FORM (S) TO FILE VIA INTERNET. Check

The designated Reporting Agent and its employees will be

all applicable boxes to indicate which tax returns the desig-

responsible for notifying its applicable clients (the taxpayer

nated Reporting Agent and its employees are authorized (a)

or employer) of the Reporting Agent’s eligibility to partici-

to sign and file via the Internet and (b) to make related pay-

pate in the Department of Taxation’s Internet Bulk Filing

ments. Enter the periods the designated Reporting Agent

System.

and its employees are authorized to begin signing and filing

the indicated tax returns and to begin making related pay-

For general information about the Bulk Filing program

ments.

contact:

PART IV, AUTHORIZATION AGREEMENT. Carefully read

State of Hawaii Department of Taxation

the authorization agreement and sign, date, and print name

Oahu District Office

and title.

Taxpayer Services Branch

P. O. Box 259

Honolulu, HI 96809-0259

FORM EF-3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1