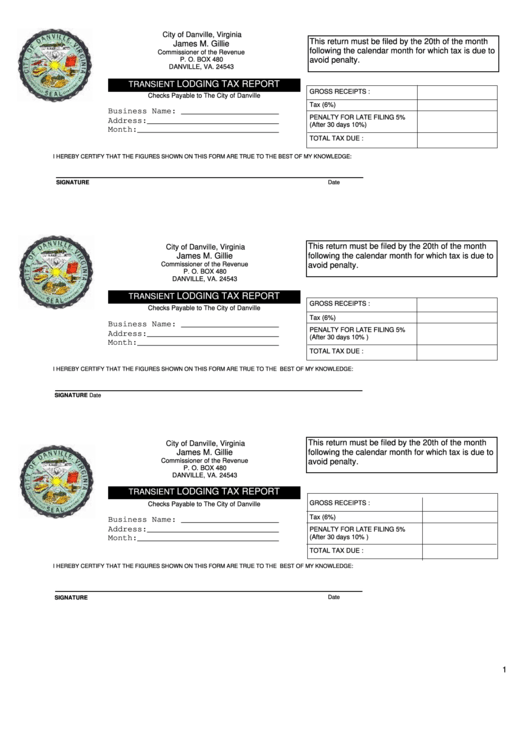

Transient Lodging Tax Report Form - Commissioner Of The Revenue City Of Danville, Virginia

ADVERTISEMENT

City of Danville, Virginia

This return must be filed by the 20th of the month

James M. Gillie

following the calendar month for which tax is due to

Commissioner of the Revenue

P. O. BOX 480

avoid penalty.

DANVILLE, VA. 24543

LODGING TAX REPORT

TRANSIENT

GROSS RECEIPTS :

Checks Payable to The City of Danville

Tax (6%)

Business Name: ____________________

PENALTY FOR LATE FILING 5%

Address:___________________________

(After 30 days 10%)

Month:_____________________________

TOTAL TAX DUE :

I HEREBY CERTIFY THAT THE FIGURES SHOWN ON THIS FORM ARE TRUE TO THE BEST OF MY KNOWLEDGE:

SIGNATURE

Date

This return must be filed by the 20th of the month

City of Danville, Virginia

James M. Gillie

following the calendar month for which tax is due to

Commissioner of the Revenue

avoid penalty.

P. O. BOX 480

DANVILLE, VA. 24543

LODGING TAX REPORT

TRANSIENT

GROSS RECEIPTS :

Checks Payable to The City of Danville

Tax (6%)

Business Name: ____________________

PENALTY FOR LATE FILING 5%

Address:___________________________

(After 30 days 10% )

Month:_____________________________

TOTAL TAX DUE :

I HEREBY CERTIFY THAT THE FIGURES SHOWN ON THIS FORM ARE TRUE TO THE BEST OF MY KNOWLEDGE:

Date

SIGNATURE

This return must be filed by the 20th of the month

City of Danville, Virginia

following the calendar month for which tax is due to

James M. Gillie

Commissioner of the Revenue

avoid penalty.

P. O. BOX 480

DANVILLE, VA. 24543

LODGING TAX REPORT

TRANSIENT

GROSS RECEIPTS :

Checks Payable to The City of Danville

Tax (6%)

Business Name: ____________________

Address:___________________________

PENALTY FOR LATE FILING 5%

(After 30 days 10% )

Month:_____________________________

TOTAL TAX DUE :

I HEREBY CERTIFY THAT THE FIGURES SHOWN ON THIS FORM ARE TRUE TO THE BEST OF MY KNOWLEDGE:

SIGNATURE

Date

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1