Instructions For Form M-6gs 2010

ADVERTISEMENT

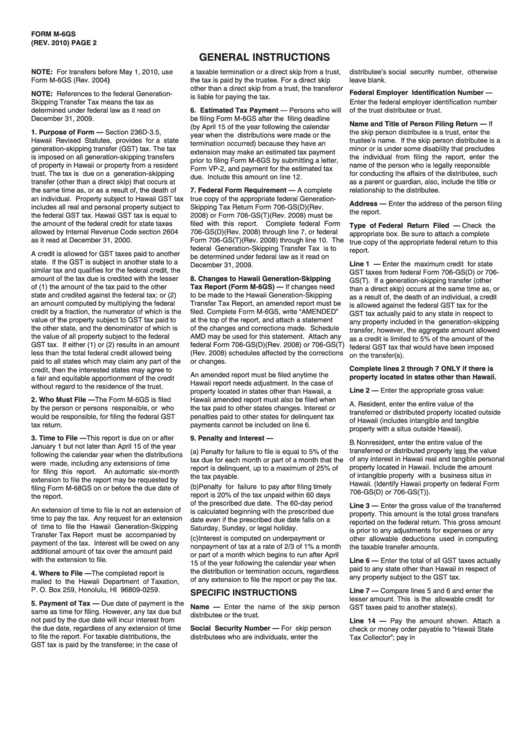

FORM M-6GS

(REV. 2010)

PAGE 2

GENERAL INSTRUCTIONS

NOTE: For transfers before May 1, 2010, use

a taxable termination or a direct skip from a trust,

distributee’s social security number, otherwise

Form M-6GS (Rev. 2004)

the tax is paid by the trustee. For a direct skip

leave blank.

other than a direct skip from a trust, the transferor

NOTE: References to the federal Generation-

Federal Employer Identification Number —

is liable for paying the tax.

Skipping Transfer Tax means the tax as

Enter the federal employer identification number

6. Estimated Tax Payment — Persons who will

determined under federal law as it read on

of the trust distributee or trust.

December 31, 2009.

be filing Form M-6GS after the filing deadline

Name and Title of Person Filing Return — If

(by April 15 of the year following the calendar

1. Purpose of Form — Section 236D-3.5,

the skip person distributee is a trust, enter the

year when the distributions were made or the

Hawaii Revised Statutes, provides for a state

trustee’s name. If the skip person distributee is a

termination occurred) because they have an

generation-skipping transfer (GST) tax. The tax

minor or is under some disability that precludes

extension may make an estimated tax payment

is imposed on all generation-skipping transfers

the individual from filing the report, enter the

prior to filing Form M-6GS by submitting a letter,

of property in Hawaii or property from a resident

name of the person who is legally responsible

Form VP-2, and payment for the estimated tax

trust. The tax is due on a generation-skipping

for conducting the affairs of the distributee, such

due. Include this amount on line 12.

transfer (other than a direct skip) that occurs at

as a parent or guardian, also, include the title or

7. Federal Form Requirement — A complete

the same time as, or as a result of, the death of

relationship to the distributee.

an individual. Property subject to Hawaii GST tax

true copy of the appropriate federal Generation-

Address — Enter the address of the person filing

includes all real and personal property subject to

Skipping Tax Return Form 706-GS(D)(Rev.

the report.

the federal GST tax. Hawaii GST tax is equal to

2008) or Form 706-GS(T)(Rev. 2008) must be

the amount of the federal credit for state taxes

filed with this report. Complete federal Form

Type of Federal Return Filed — Check the

allowed by Internal Revenue Code section 2604

706-GS(D)(Rev. 2008) through line 7, or federal

appropriate box. Be sure to attach a complete

as it read at December 31, 2000.

Form 706-GS(T)(Rev. 2008) through line 10. The

true copy of the appropriate federal return to this

federal Generation-Skipping Transfer Tax is to

report.

A credit is allowed for GST taxes paid to another

be determined under federal law as it read on

state. If the GST is subject in another state to a

Line 1 — Enter the maximum credit for state

December 31, 2009.

similar tax and qualifies for the federal credit, the

GST taxes from federal Form 706-GS(D) or 706-

8. Changes to Hawaii Generation-Skipping

amount of the tax due is credited with the lesser

GS(T). If a generation-skipping transfer (other

Tax Report (Form M-6GS) — If changes need

of (1) the amount of the tax paid to the other

than a direct skip) occurs at the same time as, or

state and credited against the federal tax; or (2)

to be made to the Hawaii Generation-Skipping

as a result of, the death of an individual, a credit

an amount computed by multiplying the federal

Transfer Tax Report, an amended report must be

is allowed against the federal GST tax for the

credit by a fraction, the numerator of which is the

filed. Complete Form M-6GS, write “AMENDED”

GST tax actually paid to any state in respect to

value of the property subject to GST tax paid to

at the top of the report, and attach a statement

any property included in the generation-skipping

the other state, and the denominator of which is

of the changes and corrections made. Schedule

transfer, however, the aggregate amount allowed

the value of all property subject to the federal

AMD may be used for this statement. Attach any

as a credit is limited to 5% of the amount of the

GST tax. If either (1) or (2) results in an amount

federal Form 706-GS(D)(Rev. 2008) or 706-GS(T)

federal GST tax that would have been imposed

less than the total federal credit allowed being

(Rev. 2008) schedules affected by the corrections

on the transfer(s).

paid to all states which may claim any part of the

or changes.

Complete lines 2 through 7 ONLY if there is

credit, then the interested states may agree to

An amended report must be filed anytime the

property located in states other than Hawaii.

a fair and equitable apportionment of the credit

Hawaii report needs adjustment. In the case of

without regard to the residence of the trust.

Line 2 — Enter the appropriate gross value:

property located in states other than Hawaii, a

2. Who Must File —The Form M-6GS is filed

Hawaii amended report must also be filed when

A. Resident, enter the entire value of the

by the person or persons responsible, or who

the tax paid to other states changes. Interest or

transferred or distributed property located outside

would be responsible, for filing the federal GST

penalties paid to other states for delinquent tax

of Hawaii (includes intangible and tangible

tax return.

payments cannot be included on line 6.

property with a situs outside Hawaii).

3. Time to File —This report is due on or after

9. Penalty and Interest —

B. Nonresident, enter the entire value of the

January 1 but not later than April 15 of the year

(a) Penalty for failure to file is equal to 5% of the

transferred or distributed property less the value

following the calendar year when the distributions

of any interest in Hawaii real and tangible personal

tax due for each month or part of a month that the

were made, including any extensions of time

property located in Hawaii. Include the amount

report is delinquent, up to a maximum of 25% of

for filing this report.

An automatic six-month

of intangible property with a business situs in

the tax payable.

extension to file the report may be requested by

Hawaii. (Identify Hawaii property on federal Form

(b) Penalty for failure to pay after filing timely

filing Form M-68GS on or before the due date of

706-GS(D) or 706-GS(T)).

report is 20% of the tax unpaid within 60 days

the report.

of the prescribed due date. The 60-day period

Line 3 — Enter the gross value of the transferred

An extension of time to file is not an extension of

is calculated beginning with the prescribed due

property. This amount is the total gross transfers

time to pay the tax. Any request for an extension

date even if the prescribed due date falls on a

reported on the federal return. This gross amount

of time to file the Hawaii Generation-Skipping

Saturday, Sunday, or legal holiday.

is prior to any adjustments for expenses or any

Transfer Tax Report must be accompanied by

(c) Interest is computed on underpayment or

other allowable deductions used in computing

payment of the tax. Interest will be owed on any

nonpayment of tax at a rate of 2/3 of 1% a month

the taxable transfer amounts.

additional amount of tax over the amount paid

or part of a month which begins to run after April

Line 6 — Enter the total of all GST taxes actually

with the extension to file.

15 of the year following the calendar year when

paid to any state other than Hawaii in respect of

the distribution or termination occurs, regardless

4. Where to File —The completed report is

any property subject to the GST tax.

of any extension to file the report or pay the tax.

mailed to the Hawaii Department of Taxation,

Line 7 — Compare lines 5 and 6 and enter the

P. O. Box 259, Honolulu, HI 96809-0259.

SPECIFIC INSTRUCTIONS

lesser amount. This is the allowable credit for

5. Payment of Tax — Due date of payment is the

Name — Enter the name of the skip person

GST taxes paid to another state(s).

same as time for filing. However, any tax due but

distributee or the trust.

Line 14 — Pay the amount shown. Attach a

not paid by the due date will incur interest from

Social Security Number — For skip person

the due date, regardless of any extension of time

check or money order payable to “Hawaii State

to file the report. For taxable distributions, the

distributees who are individuals, enter the

Tax Collector”; pay in U.S. dollars drawn on any

GST tax is paid by the transferee; in the case of

U.S. bank. Do not send cash.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1