Print and Reset Form

Reset Form

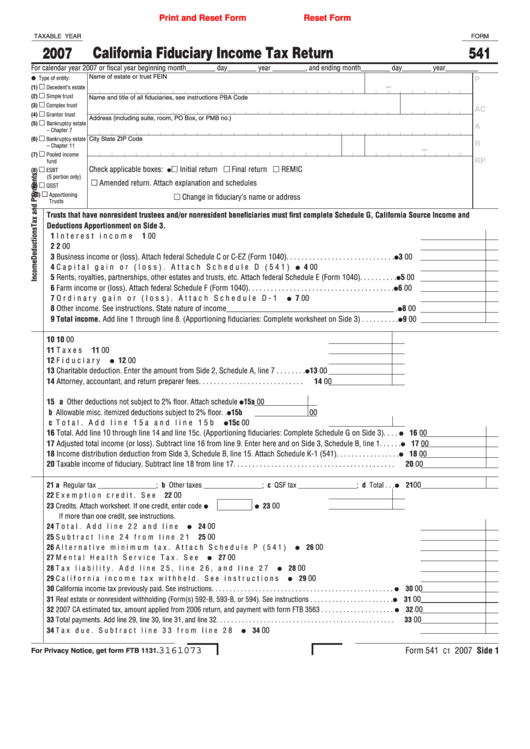

TAXABLE YEAR

FORM

California Fiduciary Income Tax Return

2007

541

For calendar year 2007 or fiscal year beginning month________ day________ year _________, and ending month________ day________ year_________

Name of estate or trust

FEIN

Type of entity:

P

(�)

Decedent’s estate

(2)

Simple trust

Name and title of all fiduciaries, see instructions

PBA Code

(3)

Complex trust

AC

(4)

Grantor trust

Address (including suite, room, PO Box, or PMB no.)

(5)

Bankruptcy estate

A

– Chapter 7

(6)

Bankruptcy estate

City

State

ZIP Code

R

– Chapter 11

(7)

Pooled income

RP

fund

Check applicable boxes: Initial return

Final return

REMIC

(8)

ESBT

(S portion only)

Amended return. Attach explanation and schedules

(9)

QSST

(�0)

Apportioning

Change in fiduciary’s name or address

Trusts

Trusts that have nonresident trustees and/or nonresident beneficiaries must first complete Schedule G, California Source Income and

Deductions Apportionment on Side 3.

� Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�

00

2 Dividends. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3 Business income or (loss). Attach federal Schedule C or C-EZ (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Capital gain or (loss). Attach Schedule D (541) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5 Rents, royalties, partnerships, other estates and trusts, etc. Attach federal Schedule E (Form 1040) . . . . . . . . . .

5

00

6 Farm income or (loss). Attach federal Schedule F (Form 1040). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Ordinary gain or (loss). Attach Schedule D-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Other income. See instructions. State nature of income___________________________________________ .

8

00

9 Total income. Add line 1 through line 8. (Apportioning fiduciaries: Complete worksheet on Side 3) . . . . . . . . . .

9

00

�0 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�0

00

�� Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

��

00

�2 Fiduciary fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�2

00

�3 Charitable deduction. Enter the amount from Side 2, Schedule A, line 7 . . . . . . . .

�3

00

�4 Attorney, accountant, and return preparer fees. . . . . . . . . . . . . . . . . . . . . . . . . . . .

�4

00

�5 a Other deductions not subject to 2% floor. Attach schedule

�5a

00

b Allowable misc. itemized deductions subject to 2% floor. .

�5b

00

c Total. Add line 15a and line 15b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�5c

00

�6 Total. Add line 10 through line 14 and line 15c. (Apportioning fiduciaries: Complete Schedule G on Side 3). . . .

�6

00

�7 Adjusted total income (or loss). Subtract line 16 from line 9. Enter here and on Side 3, Schedule B, line 1. . . . . .

�7

00

�8 Income distribution deduction from Side 3, Schedule B, line 15. Attach Schedule K-1 (541). . . . . . . . . . . . . . . . .

�8

00

20 Taxable income of fiduciary. Subtract line 18 from line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

00

00

2� a Regular tax ________________; b Other taxes ________________; c QSF tax ________________; d Total . . .

2�

00

22 Exemption credit. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

23 Credits. Attach worksheet. If one credit, enter code

. . . . . . . . . . . . . . .

23

If more than one credit, see instructions.

00

24 Total. Add line 22 and line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

00

25 Subtract line 24 from line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

00

26 Alternative minimum tax. Attach Schedule P (541) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

00

27 Mental Health Service Tax. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

28 Tax liability. Add line 25, line 26, and line 27 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

00

00

29 California income tax withheld. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

00

30 California income tax previously paid. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

00

3� Real estate or nonresident withholding (Form(s) 592-B, 593-B, or 594). See instructions . . . . . . . . . . . . . . . . . . . . . . .

3�

00

32 2007 CA estimated tax, amount applied from 2006 return, and payment with form FTB 3563 . . . . . . . . . . . . . . . . . . . .

32

33 Total payments. Add line 29, line 30, line 31, and line 32. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

00

00

34 Tax due. Subtract line 33 from line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

3161073

Form 541

2007 Side �

For Privacy Notice, get form FTB 1131.

C1

1

1 2

2 3

3