2015 Business Tax Return Form - Municipality Of Monroeville

ADVERTISEMENT

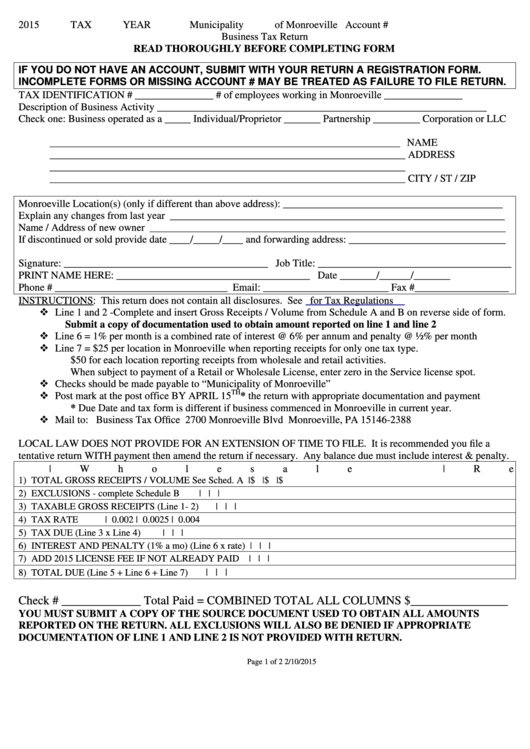

2015 TAX YEAR

Municipality of Monroeville

Account #

Business Tax Return

READ THOROUGHLY BEFORE COMPLETING FORM

IF YOU DO NOT HAVE AN ACCOUNT, SUBMIT WITH YOUR RETURN A REGISTRATION FORM.

INCOMPLETE FORMS OR MISSING ACCOUNT # MAY BE TREATED AS FAILURE TO FILE RETURN.

TAX IDENTIFICATION # _______________

# of employees working in Monroeville _______________

Description of Business Activity _______________________________________________________________

Check one: Business operated as a _____ Individual/Proprietor _______ Partnership _________ Corporation or LLC

___________________________________________________________________ NAME

____________________________________________________________________ ADDRESS

____________________________________________________________________

____________________________________________________________________ CITY / ST / ZIP

Monroeville Location(s) (only if different than above address): __________________________________________

Explain any changes from last year ________________________________________________________________

Name / Address of new owner ____________________________________________________________________

If discontinued or sold provide date ____/_____/____ and forwarding address: ______________________________

Signature: _______________________________________ Job Title: _____________________________________

PRINT NAME HERE: _____________________________________ Date _______/______/_______

Phone # _________________________________ Email: ________________________ Fax #__________________

INSTRUCTIONS: This return does not contain all disclosures. See

for Tax Regulations

Line 1 and 2 -Complete and insert Gross Receipts / Volume from Schedule A and B on reverse side of form.

Submit a copy of documentation used to obtain amount reported on line 1 and line 2

Line 6 = 1% per month is a combined rate of interest @ 6% per annum and penalty @ ½% per month

Line 7 = $25 per location in Monroeville when reporting receipts for only one tax type.

$50 for each location reporting receipts from wholesale and retail activities.

When subject to payment of a Retail or Wholesale License, enter zero in the Service license spot.

Checks should be made payable to “Municipality of Monroeville”

TH

Post mark at the post office BY APRIL 15

* the return with appropriate documentation and payment

* Due Date and tax form is different if business commenced in Monroeville in current year.

Mail to: Business Tax Office 2700 Monroeville Blvd Monroeville, PA 15146-2388

LOCAL LAW DOES NOT PROVIDE FOR AN EXTENSION OF TIME TO FILE. It is recommended you file a

tentative return WITH payment then amend the return if necessary. Any balance due must include interest & penalty.

|Wholesale

|Retail

|Service

1) TOTAL GROSS RECEIPTS / VOLUME See Sched. A |$

|$

|$

2) EXCLUSIONS - complete Schedule B

|

|

|

3) TAXABLE GROSS RECEIPTS (Line 1- 2)

|

|

|

4) TAX RATE

|

0.002 |

0.0025 |

0.004

5) TAX DUE (Line 3 x Line 4)

|

|

|

6) INTEREST AND PENALTY (1% a mo) (Line 6 x rate) |

|

|

7) ADD 2015 LICENSE FEE IF NOT ALREADY PAID |

|

|

|

|

|

8) TOTAL DUE (Line 5 + Line 6 + Line 7)

Check # _____________ Total Paid = COMBINED TOTAL ALL COLUMNS $________________

YOU MUST SUBMIT A COPY OF THE SOURCE DOCUMENT USED TO OBTAIN ALL AMOUNTS

REPORTED ON THE RETURN. ALL EXCLUSIONS WILL ALSO BE DENIED IF APPROPRIATE

DOCUMENTATION OF LINE 1 AND LINE 2 IS NOT PROVIDED WITH RETURN.

Page 1 of 2

2/10/2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2