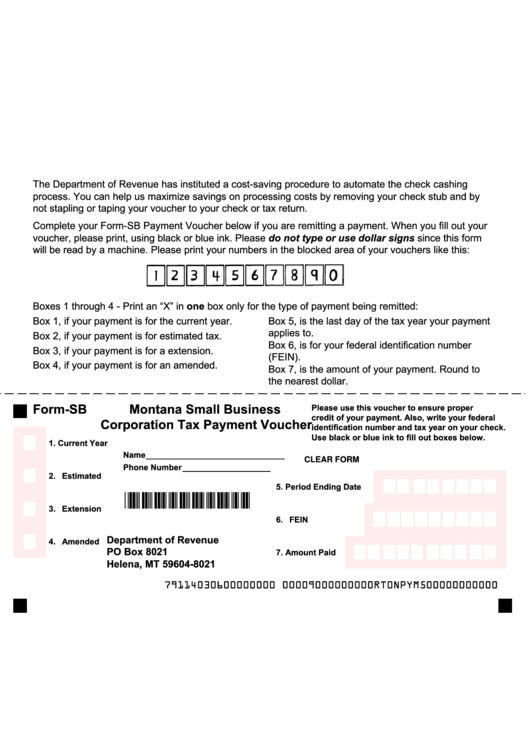

The Department of Revenue has instituted a cost-saving procedure to automate the check cashing

process. You can help us maximize savings on processing costs by removing your check stub and by

not stapling or taping your voucher to your check or tax return.

Complete your Form-SB Payment Voucher below if you are remitting a payment. When you fill out your

voucher, please print, using black or blue ink. Please do not type or use dollar signs since this form

will be read by a machine. Please print your numbers in the blocked area of your vouchers like this:

Boxes 1 through 4 - Print an “X” in one box only for the type of payment being remitted:

Box 1, if your payment is for the current year.

Box 5, is the last day of the tax year your payment

applies to.

Box 2, if your payment is for estimated tax.

Box 6, is for your federal identification number

Box 3, if your payment is for a extension.

(FEIN).

Box 4, if your payment is for an amended.

Box 7, is the amount of your payment. Round to

the nearest dollar.

Form-SB

Montana Small Business

Please use this voucher to ensure proper

credit of your payment. Also, write your federal

Corporation Tax Payment Voucher

identification number and tax year on your check.

Use black or blue ink to fill out boxes below.

1. Current Year

Name ______________________________

CLEAR FORM

Phone Number ___________________

2. Estimated

5. Period Ending Date

*00100101*

3. Extension

6. FEIN

Department of Revenue

4. Amended

PO Box 8021

7. Amount Paid

Helena, MT 59604-8021

79114030600000000 00009000000000RT

0

NPYM500000000000

1

1