ITI

0101298

000

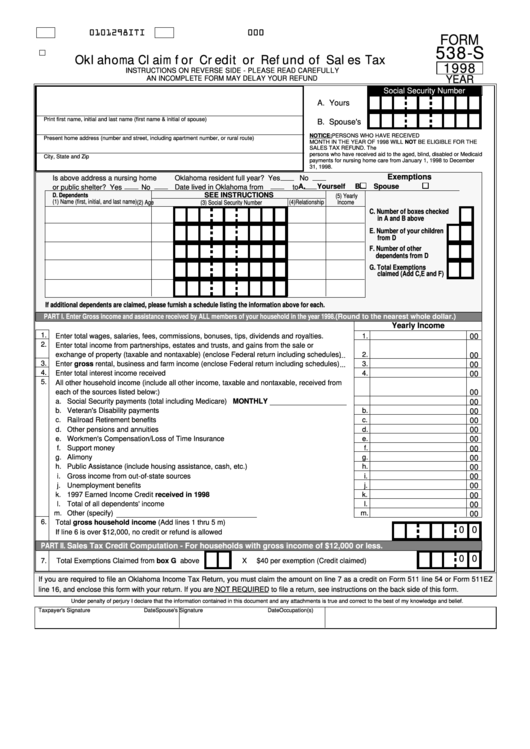

FORM

538-S

Oklahoma Claim for Credit or Refund of Sales Tax

1998

INSTRUCTIONS ON REVERSE SIDE - PLEASE READ CAREFULLY

AN INCOMPLETE FORM MAY DELAY YOUR REFUND

YEAR

Social Security Number

A. Yours

Print first name, initial and last name (first name & initial of spouse)

B. Spouse's

NOTICE: PERSONS WHO HAVE RECEIVED T.A.N.F. FOR ANY

Present home address (number and street, including apartment number, or rural route)

MONTH IN THE YEAR OF 1998 WILL NOT BE ELIGIBLE FOR THE

SALES TAX REFUND. The D.H.S. will make sales tax refunds to

persons who have received aid to the aged, blind, disabled or Medicaid

City, State and Zip

payments for nursing home care from January 1, 1998 to December

31, 1998.

Exemptions

Is above address a nursing home

Oklahoma resident full year? Yes

No

A.

Yourself

B.

Spouse

or public shelter? Yes

No

Date lived in Oklahoma from

to

SEE INSTRUCTIONS

D. Dependents

(5) Yearly

(1) Name (first, initial, and last name)

(2) Age

(3) Social Security Number

(4)Relationship

Income

C. Number of boxes checked

in A and B above

...............

E. Number of your children

from D

......................

F. Number of other

......

dependents from D

G. Total Exemptions

claimed (Add C,E and F)

If additional dependents are claimed, please furnish a schedule listing the information above for each.

PART I. Enter Gross income and assistance received by ALL members of your household in the year 1998.

(Round to the nearest whole dollar.)

Yearly Income

1.

Enter total wages, salaries, fees, commissions, bonuses, tips, dividends and royalties.

1.

00

............

2.

Enter total income from partnerships, estates and trusts, and gains from the sale or

exchange of property (taxable and nontaxable) (enclose Federal return including schedules)

2.

00

...

3.

Enter gross rental, business and farm income (enclose Federal return including schedules)

3.

00

...

4.

Enter total interest income received

4.

00

............................................................................................

5.

All other household income (include all other income, taxable and nontaxable, received from

each of the sources listed below:)

00

a.

Social Security payments (total including Medicare) MONTHLY

5.a.

00

b.

Veteran's Disability payments

b.

00

...............................................................................................

c.

Railroad Retirement benefits

c.

00

................................................................................................

d.

Other pensions and annuities

d.

00

..............................................................................................

e.

Workmen's Compensation/Loss of Time Insurance

e.

00

.............................................................

f.

Support money

f.

00

.....................................................................................................................

g.

Alimony

g.

00

...............................................................................................................................

h.

Public Assistance (include housing assistance, cash, etc.)

h.

00

.................................................

i.

Gross income from out-of-state sources

i.

00

..............................................................................

j.

Unemployment benefits

j.

00

......................................................................................................

k.

1997 Earned Income Credit received in 1998

k.

00

......................................................................

l.

Total of all dependents' income

l.

00

.........................................................................................

m.

Other (specify)

m.

00

.............................................

6.

Total gross household income (Add lines 1 thru 5 m)

0 0

If line 6 is over $12,000, no credit or refund is allowed

..............................................................

PART II. Sales Tax Credit Computation - For households with gross income of $12,000 or less.

0 0

7.

Total Exemptions Claimed from box G above

X

$40 per exemption (Credit claimed)

................

If you are required to file an Oklahoma Income Tax Return, you must claim the amount on line 7 as a credit on Form 511 line 54 or Form 511EZ

line 16, and enclose this form with your return. If you are NOT REQUIRED to file a return, see instructions on the back side of this form.

Under penalty of perjury I declare that the information contained in this document and any attachments is true and correct to the best of my knowledge and belief.

Taxpayer's Signature

Date

Spouse's Signature

Date

Occupation(s)

1

1