Employer'S Quarterly Earned Income Tax Return Form - Palmer Township

ADVERTISEMENT

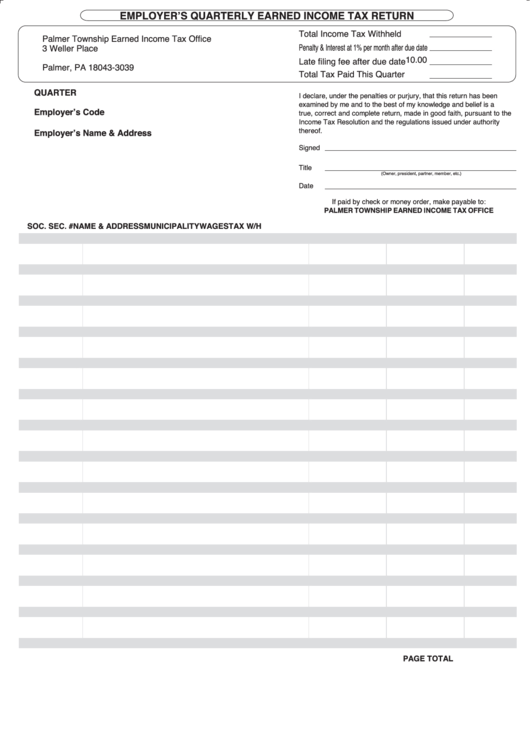

EMPLOYER’S QUARTERLY EARNED INCOME TAX RETURN

Total Income Tax Withheld

Palmer Township Earned Income Tax Office

Penalty & Interest at 1% per month after due date

3 Weller Place

P.O. Box 3039

10.00

Late filing fee after due date

Palmer, PA 18043-3039

Total Tax Paid This Quarter

QUARTER

I declare, under the penalties or purjury, that this return has been

examined by me and to the best of my knowledge and belief is a

Employer’s Code

true, correct and complete return, made in good faith, pursuant to the

Income Tax Resolution and the regulations issued under authority

thereof.

Employer’s Name & Address

Signed

Title

(Owner, president, partner, member, etc.)

Date

If paid by check or money order, make payable to:

PALMER TOWNSHIP EARNED INCOME TAX OFFICE

SOC. SEC. #

NAME & ADDRESS

MUNICIPALITY

WAGES

TAX W/H

PAGE TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2