Reset

Print Form

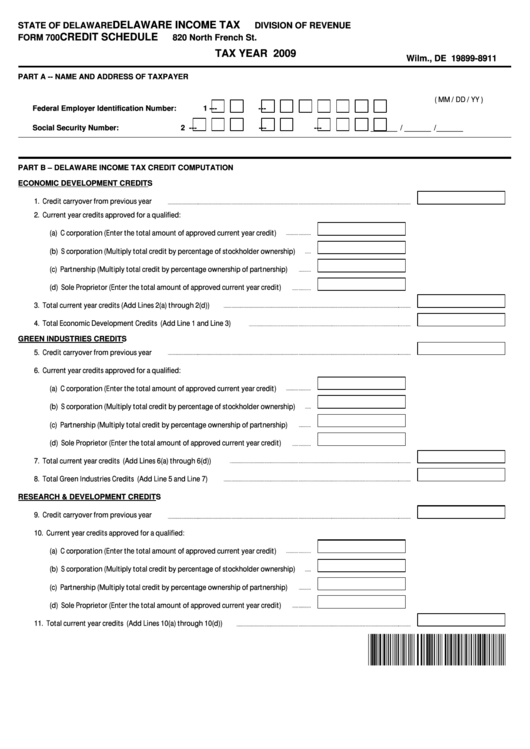

DELAWARE INCOME TAX

STATE OF DELAWARE

DIVISION OF REVENUE

CREDIT SCHEDULE

FORM 700

820 North French St.

P.O. Box 8911

TAX YEAR 2009

Wilm., DE 19899-8911

PART A -- NAME AND ADDRESS OF TAXPAYER

1. Enter Federal Employer Identification Number or Social Security Number

Tax Period Ending Date

( MM / DD / YY )

Federal Employer Identification Number:

1 ---

---

Social Security Number:

2 ---

---

---

_______ / _______ /_______

2. Name of Taxpayer

PART B – DELAWARE INCOME TAX CREDIT COMPUTATION

ECONOMIC DEVELOPMENT CREDITS

1.

Credit carryover from previous year

2.

Current year credits approved for a qualified:

(a ) C corporation (Enter the total amount of approved current year credit)

(b) S corporation (Multiply total credit by percentage of stockholder ownership)

(c) Partnership (Multiply total credit by percentage ownership of partnership)

(d) Sole Proprietor (Enter the total amount of approved current year credit)

3.

Total current year credits (Add Lines 2(a) through 2(d))

4.

Total Economic Development Credits (Add Line 1 and Line 3)

GREEN INDUSTRIES CREDITS

5.

Credit carryover from previous year

6.

Current year credits approved for a qualified:

(a ) C corporation (Enter the total amount of approved current year credit)

(b) S corporation (Multiply total credit by percentage of stockholder ownership)

(c) Partnership (Multiply total credit by percentage ownership of partnership)

(d) Sole Proprietor (Enter the total amount of approved current year credit)

7.

Total current year credits (Add Lines 6(a) through 6(d))

8.

Total Green Industries Credits (Add Line 5 and Line 7)

RESEARCH & DEVELOPMENT CREDITS

9.

Credit carryover from previous year

10. Current year credits approved for a qualified:

(a ) C corporation (Enter the total amount of approved current year credit)

(b) S corporation (Multiply total credit by percentage of stockholder ownership)

(c) Partnership (Multiply total credit by percentage ownership of partnership)

(d) Sole Proprietor (Enter the total amount of approved current year credit)

11. Total current year credits (Add Lines 10(a) through 10(d))

1

1 2

2 3

3