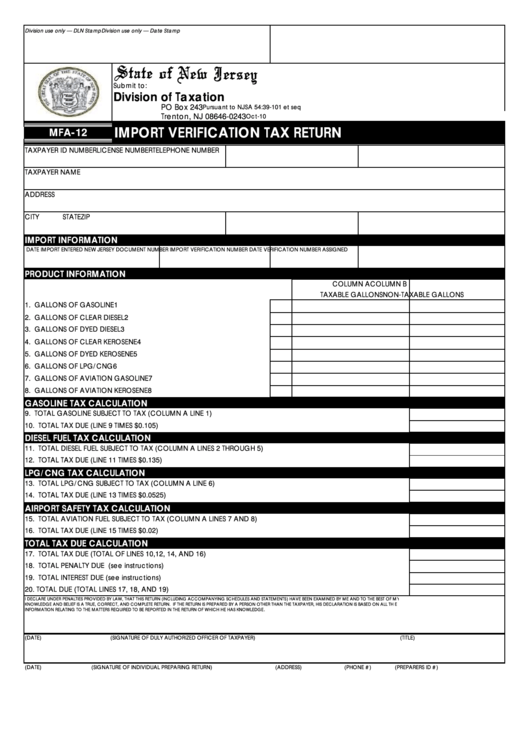

Form Mfa-12 - Import Verification Tax Return

ADVERTISEMENT

Division use only — DLN Stamp

Division use only — Date Stamp

Submit to:

Division of Taxation

PO Box 243

Pursuant to NJSA 54:39-101 et seq

Trenton, NJ 08646-0243

Oct-10

IMPORT VERIFICATION TAX RETURN

MFA-12

TAXPAYER ID NUMBER

LICENSE NUMBER

TELEPHONE NUMBER

TAXPAYER NAME

ADDRESS

CITY

STATE

ZIP

IMPORT INFORMATION

DATE IMPORT ENTERED NEW JERSEY

DOCUMENT NUMBER

IMPORT VERIFICATION NUMBER

DATE VERIFICATION NUMBER ASSIGNED

PRODUCT INFORMATION

COLUMN A

COLUMN B

TAXABLE GALLONS

NON-TAXABLE GALLONS

1. GALLONS OF GASOLINE

1

2. GALLONS OF CLEAR DIESEL

2

3. GALLONS OF DYED DIESEL

3

4. GALLONS OF CLEAR KEROSENE

4

5. GALLONS OF DYED KEROSENE

5

6. GALLONS OF LPG/CNG

6

7. GALLONS OF AVIATION GASOLINE

7

8. GALLONS OF AVIATION KEROSENE

8

GASOLINE TAX CALCULATION

9. TOTAL GASOLINE SUBJECT TO TAX (COLUMN A LINE 1)

10. TOTAL TAX DUE (LINE 9 TIMES $0.105)

DIESEL FUEL TAX CALCULATION

11. TOTAL DIESEL FUEL SUBJECT TO TAX (COLUMN A LINES 2 THROUGH 5)

12. TOTAL TAX DUE (LINE 11 TIMES $0.135)

LPG/CNG TAX CALCULATION

13. TOTAL LPG/CNG SUBJECT TO TAX (COLUMN A LINE 6)

14. TOTAL TAX DUE (LINE 13 TIMES $0.0525)

AIRPORT SAFETY TAX CALCULATION

15. TOTAL AVIATION FUEL SUBJECT TO TAX (COLUMN A LINES 7 AND 8)

16. TOTAL TAX DUE (LINE 15 TIMES $0.02)

TOTAL TAX DUE CALCULATION

17. TOTAL TAX DUE (TOTAL OF LINES 10,12, 14, AND 16)

18. TOTAL PENALTY DUE (see instructions)

19. TOTAL INTEREST DUE (see instructions)

20. TOTAL DUE (TOTAL LINES 17, 18, AND 19)

I DECLARE UNDER PENALTIES PROVIDED BY LAW, THAT THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) HAVE BEEN EXAMINED BY ME AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF IS A TRUE, CORRECT, AND COMPLETE RETURN. IF THE RETURN IS PREPARED BY A PERSON OTHER THAN THE TAXPAYER, HIS DECLARATION IS BASED ON ALL THE

INFORMATION RELATING TO THE MATTERS REQUIRED TO BE REPORTED IN THE RETURN OF WHICH HE HAS KNOWLEDGE.

(DATE)

(SIGNATURE OF DULY AUTHORIZED OFFICER OF TAXPAYER)

(TITLE)

(DATE)

(SIGNATURE OF INDIVIDUAL PREPARING RETURN)

(ADDRESS)

(PHONE #)

(PREPARERS ID #)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1