Streamlined Sales And Use Tax Agreement Exemption Certificate Instructions

ADVERTISEMENT

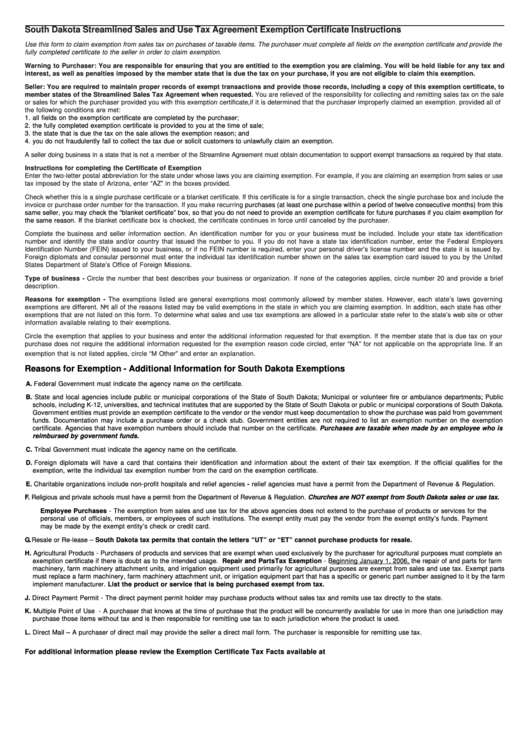

South Dakota Streamlined Sales and Use Tax Agreement Exemption Certificate Instructions

Use this form to claim exemption from sales tax on purchases of taxable items. The purchaser must complete all fields on the exemption certificate and provide the

fully completed certificate to the seller in order to claim exemption.

Warning to Purchaser: You are responsible for ensuring that you are entitled to the exemption you are claiming. You will be held liable for any tax and

interest, as well as penalties imposed by the member state that is due the tax on your purchase, if you are not eligible to claim this exemption.

Seller: You are required to maintain proper records of exempt transactions and provide those records, including a copy of this exemption certificate, to

member states of the Streamlined Sales Tax Agreement when requested. You are relieved of the responsibility for collecting and remitting sales tax on the sale

or sales for which the purchaser provided you with this exemption certificate, if it is determined that the purchaser improperly claimed an

exemption,

provided all of

the following conditions are met:

1. all fields on the exemption certificate are completed by the purchaser;

2. the fully completed exemption certificate is provided to you at the time of sale;

3. the state that is due the tax on the sale allows the exemption reason; and

4. you do not fraudulently fail to collect the tax due or solicit customers to unlawfully claim an exemption.

A seller doing business in a state that is not a member of the Streamline Agreement must obtain documentation to support exempt transactions as required by that state.

Instructions for completing the Certificate of Exemption

Enter the two-letter postal abbreviation for the state under whose laws you are claiming exemption. For example, if you are claiming an exemption from sales or use

tax imposed by the state of Arizona, enter “AZ” in the boxes provided.

Check whether this is a single purchase certificate or a blanket certificate. If this certificate is for a single transaction, check the single purchase box and include the

invoice or purchase order number for the transaction. If you make recurring

purchases (at least one purchase within a period of twelve consecutive months) from this

same seller, you may check the “blanket certificate” box, so that you do not need to provide an exemption certificate for future purchases if you claim exemption for

the same reason. If

the blanket certificate box is checked, the certificate continues in force until canceled by the purchaser.

Complete the business and seller information section. An identification number for you or your business must be included. Include your state tax identification

number and identify the state and/or country that issued the number to you. If you do not have a state tax identification number, enter the Federal Employers

Identification Number (FEIN) issued to your business, or if no FEIN number is required, enter your personal driver’s license number and the state it is issued by.

Foreign diplomats and consular personnel must enter the individual tax identification number shown on the sales tax exemption card issued to you by the United

States Department of State’s Office of Foreign Missions.

Type of business - Circle the number that best describes your business or organization. If none of the categories applies, circle number 20 and provide a brief

description.

Reasons for exemption - The exemptions listed are general exemptions most commonly allowed by member states. However, each state’s laws governing

exemptions are different. Not all of the reasons listed may be valid exemptions in the state in which you are claiming exemption. In addition, each state has other

exemptions that are not listed on this form. To determine what sales and use tax exemptions are allowed in a particular state refer to the state’s web site or other

information available relating to their exemptions.

Circle the exemption that applies to your business and enter the additional information requested for that exemption. If the member state that is due tax on your

purchase does not require the additional information requested for the exemption reason code circled, enter “NA” for not applicable on the appropriate line. If an

exemption that is not listed applies, circle “M Other” and enter an explanation.

Reasons for Exemption - Additional Information for South Dakota Exemptions

A. Federal Government must indicate the agency name on the certificate.

B. State and local agencies include public or municipal corporations of the State of South Dakota; Municipal or volunteer fire or ambulance departments; Public

schools, including K-12, universities, and technical institutes that are supported by the State of South Dakota or public or municipal corporations of South Dakota.

Government entities must provide an exemption certificate to the vendor or the vendor must keep documentation to show the purchase was paid from government

funds. Documentation may include a purchase order or a check stub. Government entities are not required to list an exemption number on the exemption

certificate. Agencies that have exemption numbers should include that number on the certificate. Purchases are taxable when made by an employee who is

reimbursed by government funds.

C. Tribal Government must indicate the agency name on the certificate.

D. Foreign diplomats will have a card that contains their identification and information about the extent of their tax exemption. If the official qualifies for the

exemption, write the individual tax exemption number from the card on the exemption certificate.

E. Charitable organizations include non-profit hospitals and relief agencies - relief agencies must have a permit from the Department of Revenue & Regulation.

F. Religious and private schools must have a permit from the Department of Revenue & Regulation. Churches are NOT exempt from South Dakota sales or use tax.

Employee Purchases - The exemption from sales and use tax for the above agencies does not extend to the purchase of products or services for the

personal use of officials, members, or employees of such institutions. The exempt entity must pay the vendor from the exempt entity’s funds. Payment

may be made by the exempt entity’s check or credit card.

G. Resale or Re-lease – South Dakota tax permits that contain the letters “UT” or “ET” cannot purchase products for resale.

H. Agricultural Products - Purchasers of products and services that are exempt when used exclusively by the purchaser for agricultural purposes must complete an

exemption certificate if there is doubt as to the intended usage. Repair and Parts Tax Exemption - Beginning January 1, 2006, the repair of and parts for farm

machinery, farm machinery attachment units, and irrigation equipment used primarily for agricultural purposes are exempt from sales and use tax. Exempt parts

must replace a farm machinery, farm machinery attachment unit, or irrigation equipment part that has a specific or generic part number assigned to it by the farm

implement manufacturer. List the product or service that is being purchased exempt from tax.

J. Direct Payment Permit - The direct payment permit holder may purchase products without sales tax and remits use tax directly to the state.

K. Multiple Point of Use - A purchaser that knows at the time of purchase that the product will be concurrently available for use in more than one jurisdiction may

purchase those items without tax and is then responsible for remitting use tax to each jurisdiction where the product is used.

L. Direct Mail – A purchaser of direct mail may provide the seller a direct mail form. The purchaser is responsible for remitting use tax.

For additional information please review the Exemption Certificate Tax Facts available at or by calling 1-800-829-9188.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1