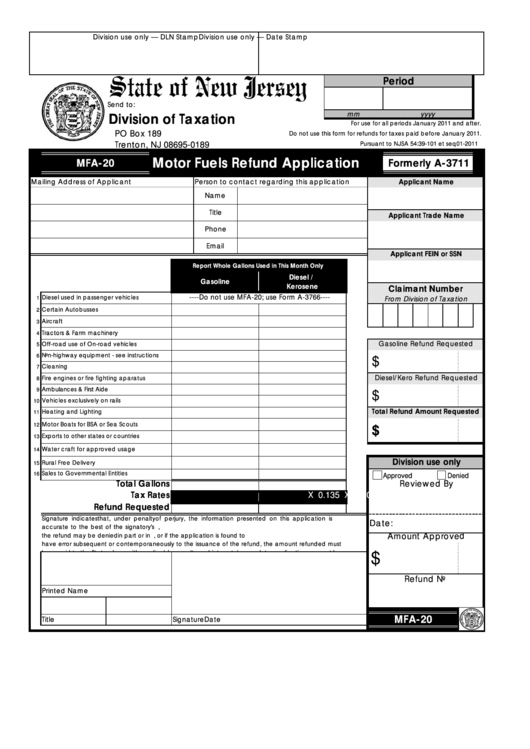

Division use only — DLN Stamp

Division use only — Date Stamp

Period

Send to:

mm

yyyy

Division of Taxation

For use for all periods January 2011 and after.

PO Box 189

Do not use this form for refunds for taxes paid before January 2011.

Trenton, NJ 08695-0189

Pursuant to NJSA 54:39-101 et seq 01-2011

Motor Fuels Refund Application

MFA-20

Formerly A-3711

Mailing Address of Applicant

Person to contact regarding this application

Applicant Name

Name

Title

Applicant Trade Name

Phone

Email

Applicant FEIN or SSN

Report Whole Gallons Used in This Month Only

Diesel /

Gasoline

Kerosene

Claimant Number

----Do not use MFA-20; use Form A-3766----

Diesel used in passenger vehicles

1

From Division of Taxation

Certain Autobusses

2

Aircraft

3

Tractors & Farm machinery

Tractors & Farm machinery

4

4

Gasoline Refund Requested

Off-road use of On-road vehicles

5

Non-highway equipment - see instructions

6

$

Cleaning

7

Diesel/Kero Refund Requested

Fire engines or fire fighting aparatus

8

Ambulances & First Aide

9

$

Vehicles exclusively on rails

10

Total Refund Amount Requested

Heating and Lighting

11

Motor Boats for BSA or Sea Scouts

12

$

Exports to other states or countries

13

Water craft for approved usage

14

Division use only

Rural Free Delivery

15

Sales to Governmental Entities

16

Approved

Denied

Total Gallons

Reviewed By

Tax Rates

X 0.105

X 0.135

Refund Requested

Signature indicates that, under penalty of perjury, the information presented on this application is

Date:

accurate to the best of the signatory's knowledge. If the information is not accurate or not verifiable,

Amount Approved

the refund may be denied in part or in whole. If a refund is paid in error, or if the application is found to

have error subsequent or contemporaneously to the issuance of the refund, the amount refunded must

$

be repaid to the State along with applicable penalty and interest Incomplete applications cannot be

Refund No

Printed Name

MFA-20

Title

Date

Signature

1

1 2

2