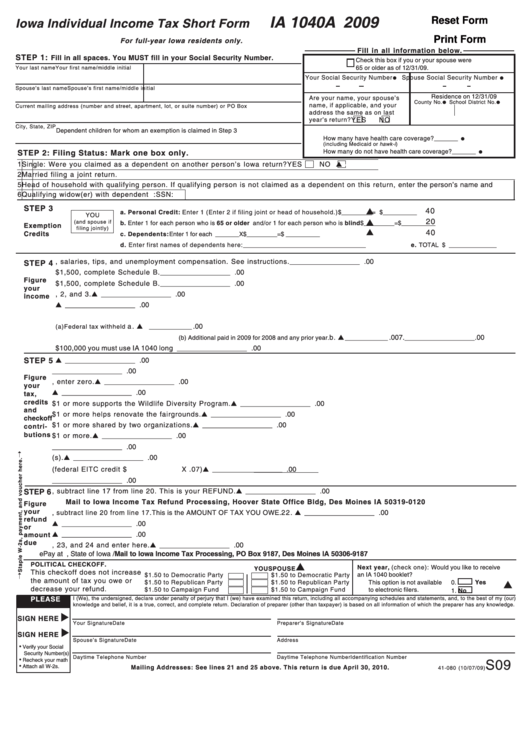

IA 1040A 2009

Iowa Individual Income Tax Short Form

Reset Form

Print Form

For full-year Iowa residents only.

Fill in all information below.

STEP 1:

Fill in all spaces. You MUST fill in your Social Security Number.

Check this box if you or your spouse were

65 or older as of 12/31/09.

Your last name

Your first name/middle initial

•

•

Your Social Security Number

Spouse Social Security Number

Spouse’s last name

Spouse’s first name/middle initial

Residence on 12/31/09

Are your name, your spouse’s

•

•

County No.

School District No.

name, if applicable, and your

Current mailing address (number and street, apartment, lot, or suite number) or PO Box

address the same as on last

YES

NO

year’s return?

City, State, ZIP

Dependent children for whom an exemption is claimed in Step 3

•

How many have health care coverage?

_______

(including Medicaid or hawk-i)

•

STEP 2: Filing Status: Mark one box only.

How many do not have health care coverage? _______

1

Single: Were you claimed as a dependent on another person’s Iowa return?

YES

NO

NONNO

2

Married filing a joint return.

5

Head of household with qualifying person. If qualifying person is not claimed as a dependent on this return, enter the person’s name and

6

Qualifying widow(er) with dependent child.

SSN here. Name:

SSN:

STEP 3

40

a. Personal Credit: Enter 1 (Enter 2 if filing joint or head of household.) .................. _______

X $ _________ = $ __________

YOU

20

(and spouse if

b. Enter 1 for each person who is 65 or older and/or 1 for each person who is blind .... _______

X $ _________ = $ __________

Exemption

filing jointly)

40

Credits

c. Dependents: Enter 1 for each dependent .................................................................... _______

X $ _________ = $ __________

d. Enter first names of dependents here: ____________________________________

e. TOTAL $ ______________

1. Total wages, salaries, tips, and unemployment compensation. See instructions. ................................... 1 .

__________________ .00

STEP 4

2. Taxable interest. If more than $1,500, complete Schedule B. ...................................................................... 2 .

__________________ .00

Figure

3. Taxable dividends. If more than $1,500, complete Schedule B. .................................................................. 3 .

__________________ .00

your

4. Net income. Add lines 1, 2, and 3.

................................................................................................................... 4 .

__________________ .00

income

5. Federal income tax refund received in 2009. .................................................................................................... 5 .

__________________ .00

6. TOTAL. Add lines 4 and 5. ................................................................................................................................... 6 .

__________________ .00

7. Federal tax payment information.

a .

___________ .00

(a) Federal tax withheld ..............................................

b.

___________ .00 7 .

__________________ .00

(b) Additional paid in 2009 for 2008 and any prior year .

8. Income subject to tax. Subtract line 7 from line 6. If greater than $100,000 you must use IA 1040 long form. .. 8 .

__________________ .00

STEP 5

9. Tax from tables. See IA 1040A tax tables at ............................................................ 9 .

__________________ .00

10. Total exemption credits from Step 3. ............................................................................................................... 1 0 .

__________________ .00

Figure

11. BALANCE. Subtract line 10 from line 9. If less than zero, enter zero. ..................................................... 11.

__________________ .00

your

12. Multiply line 11 by your school district surtax rate. See 2009 school district surtax list. ..................... 12.

__________________ .00

tax,

credits

13. Fish and Wildlife Fund Contribution. $1 or more supports the Wildlife Diversity Program. ................. 13.

__________________ .00

and

14. State Fairgrounds Renovation Contribution. $1 or more helps renovate the fairgrounds. ................... 14.

__________________ .00

checkoff

15. Volunteer Firefighters/Veterans Trust Fund. $1 or more shared by two organizations. ........................ 15.

__________________ .00

contri-

butions

16. Child Abuse Prevention. $1 or more. ............................................................................................................... 16.

__________________ .00

17. Total Tax and Contributions. Add lines 11 through 16. ............................................................................... 1 7 .

__________________ .00

18. Iowa income tax withheld from Box 17 of your W-2 form(s). ...................................................................... 18.

__________________ .00

19. Iowa Earned Income Tax Credit. (federal EITC credit $

X .07) ................................ 19.

__________________ .00

20. Total credits. Add lines 18 and 19. .................................................................................................................. 2 0 .

__________________ .00

21. If line 20 is more than line 17, subtract line 17 from line 20. This is your REFUND. ............................ 21.

__________________ .00

STEP 6

Mail to Iowa Income Tax Refund Processing, Hoover State Office Bldg, Des Moines IA 50319-0120

Figure

your

22. If line 20 is less than line 17, subtract line 20 from line 17. This is the AMOUNT OF TAX YOU OWE. ...... 22.

__________________ .00

refund

23. Penalty. See back of the IA 1040V payment voucher. ................................................................................. 23.

__________________ .00

or

24. Interest. See back of the IA 1040V payment voucher. ................................................................................. 24.

__________________ .00

amount

due

25. TOTAL AMOUNT DUE. Add lines 22, 23, and 24 and enter here. ............................................................ 25.

__________________ .00

ePay at or write check to Treasurer, State of Iowa / Mail to Iowa Income Tax Processing, PO Box 9187, Des Moines IA 50306-9187

POLITICAL CHECKOFF.

Next year, (check one): Would you like to receive

SPOUSE

YOU

This checkoff does not increase

$1.50 to Democratic Party

$1.50 to Democratic Party

an IA 1040 booklet?

the amount of tax you owe or

$1.50 to Republican Party

$1.50 to Republican Party

This option is not available

0.

Yes

decrease your refund.

$1.50 to Campaign Fund

$1.50 to Campaign Fund

to electronic filers.

1.

No

PLEASE

I (We), the undersigned, declare under penalty of perjury that I (we) have examined this return, including all accompanying schedules and statements, and, to the best of my (our)

knowledge and belief, it is a true, correct, and complete return. Declaration of preparer (other than taxpayer) is based on all information of which the preparer has any knowledge.

SIGN HERE

Your Signature

Date

Preparer’s Signature

Date

SIGN HERE

Spouse’s Signature

Date

Address

•

Verify your Social

Security Number(s)

Daytime Telephone Number

Daytime Telephone Number

Identification Number

•

Recheck your math

S09

•

Attach all W-2s.

Mailing Addresses: See lines 21 and 25 above. This return is due April 30, 2010.

41-080 (10/07/09)

1

1