Form Pt-301 - Residual Petroleum Product Exemption Certificate - New York State Department Of Taxation And Finance

ADVERTISEMENT

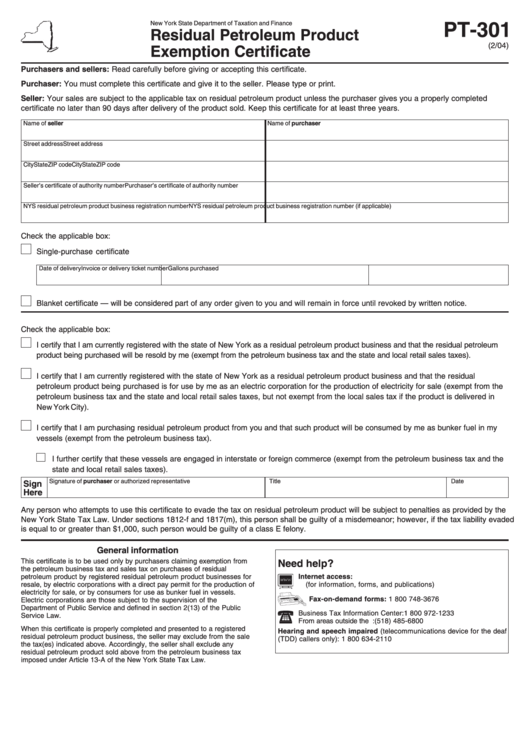

New York State Department of Taxation and Finance

PT-301

Residual Petroleum Product

(2/04)

Exemption Certificate

Purchasers and sellers: Read carefully before giving or accepting this certificate.

Purchaser: You must complete this certificate and give it to the seller. Please type or print.

Seller: Your sales are subject to the applicable tax on residual petroleum product unless the purchaser gives you a properly completed

certificate no later than 90 days after delivery of the product sold. Keep this certificate for at least three years.

Name of seller

Name of purchaser

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Seller’s certificate of authority number

Purchaser’s certificate of authority number

NYS residual petroleum product business registration number

NYS residual petroleum product business registration number (if applicable)

Check the applicable box:

Single-purchase certificate

Date of delivery

Invoice or delivery ticket number

Gallons purchased

Blanket certificate — will be considered part of any order given to you and will remain in force until revoked by written notice.

Check the applicable box:

I certify that I am currently registered with the state of New York as a residual petroleum product business and that the residual petroleum

product being purchased will be resold by me (exempt from the petroleum business tax and the state and local retail sales taxes).

I certify that I am currently registered with the state of New York as a residual petroleum product business and that the residual

petroleum product being purchased is for use by me as an electric corporation for the production of electricity for sale (exempt from the

petroleum business tax and the state and local retail sales taxes, but not exempt from the local sales tax if the product is delivered in

New York City).

I certify that I am purchasing residual petroleum product from you and that such product will be consumed by me as bunker fuel in my

vessels (exempt from the petroleum business tax).

I further certify that these vessels are engaged in interstate or foreign commerce (exempt from the petroleum business tax and the

state and local retail sales taxes).

Signature of purchaser or authorized representative

Title

Date

Sign

Here

Any person who attempts to use this certificate to evade the tax on residual petroleum product will be subject to penalties as provided by the

New York State Tax Law. Under sections 1812-f and 1817(m), this person shall be guilty of a misdemeanor; however, if the tax liability evaded

is equal to or greater than $1,000, such person would be guilty of a class E felony.

General information

This certificate is to be used only by purchasers claiming exemption from

Need help?

the petroleum business tax and sales tax on purchases of residual

petroleum product by registered residual petroleum product businesses for

Internet access:

resale, by electric corporations with a direct pay permit for the production of

(for information, forms, and publications)

electricity for sale, or by consumers for use as bunker fuel in vessels.

Fax-on-demand forms: 1 800 748-3676

Electric corporations are those subject to the supervision of the

Department of Public Service and defined in section 2(13) of the Public

Business Tax Information Center:

1 800 972-1233

Service Law.

From areas outside the U.S. and outside Canada:

(518) 485-6800

When this certificate is properly completed and presented to a registered

Hearing and speech impaired (telecommunications device for the deaf

residual petroleum product business, the seller may exclude from the sale

(TDD) callers only): 1 800 634-2110

the tax(es) indicated above. Accordingly, the seller shall exclude any

residual petroleum product sold above from the petroleum business tax

imposed under Article 13-A of the New York State Tax Law.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1