Small Claims Determination Form - New York Division Of Tax Appeals

ADVERTISEMENT

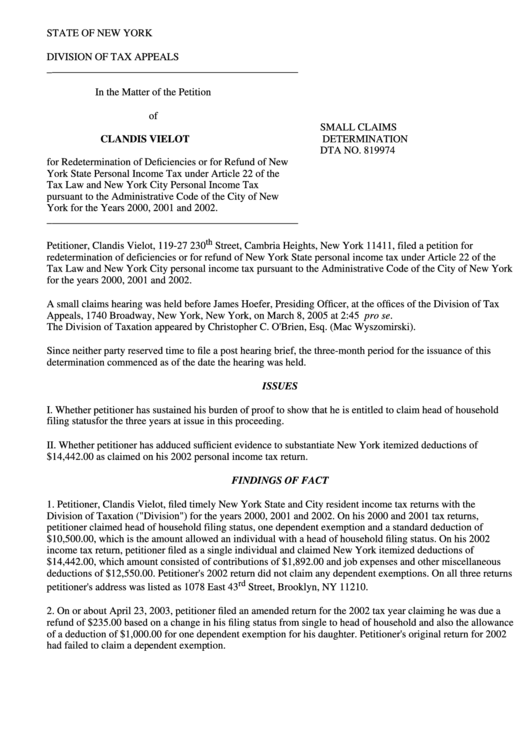

STATE OF NEW YORK

DIVISION OF TAX APPEALS

________________________________________________

In the Matter of the Petition

of

SMALL CLAIMS

CLANDIS VIELOT

DETERMINATION

DTA NO. 819974

for Redetermination of Deficiencies or for Refund of New

York State Personal Income Tax under Article 22 of the

Tax Law and New York City Personal Income Tax

pursuant to the Administrative Code of the City of New

York for the Years 2000, 2001 and 2002.

________________________________________________

th

Petitioner, Clandis Vielot, 119-27 230

Street, Cambria Heights, New York 11411, filed a petition for

redetermination of deficiencies or for refund of New York State personal income tax under Article 22 of the

Tax Law and New York City personal income tax pursuant to the Administrative Code of the City of New York

for the years 2000, 2001 and 2002.

A small claims hearing was held before James Hoefer, Presiding Officer, at the offices of the Division of Tax

Appeals, 1740 Broadway, New York, New York, on March 8, 2005 at 2:45 P.M. Petitioner appeared pro se.

The Division of Taxation appeared by Christopher C. O'Brien, Esq. (Mac Wyszomirski).

Since neither party reserved time to file a post hearing brief, the three-month period for the issuance of this

determination commenced as of the date the hearing was held.

ISSUES

I. Whether petitioner has sustained his burden of proof to show that he is entitled to claim head of household

filing status for the three years at issue in this proceeding.

II. Whether petitioner has adduced sufficient evidence to substantiate New York itemized deductions of

$14,442.00 as claimed on his 2002 personal income tax return.

FINDINGS OF FACT

1. Petitioner, Clandis Vielot, filed timely New York State and City resident income tax returns with the

Division of Taxation ("Division") for the years 2000, 2001 and 2002. On his 2000 and 2001 tax returns,

petitioner claimed head of household filing status, one dependent exemption and a standard deduction of

$10,500.00, which is the amount allowed an individual with a head of household filing status. On his 2002

income tax return, petitioner filed as a single individual and claimed New York itemized deductions of

$14,442.00, which amount consisted of contributions of $1,892.00 and job expenses and other miscellaneous

deductions of $12,550.00. Petitioner's 2002 return did not claim any dependent exemptions. On all three returns

rd

petitioner's address was listed as 1078 East 43

Street, Brooklyn, NY 11210.

2. On or about April 23, 2003, petitioner filed an amended return for the 2002 tax year claiming he was due a

refund of $235.00 based on a change in his filing status from single to head of household and also the allowance

of a deduction of $1,000.00 for one dependent exemption for his daughter. Petitioner's original return for 2002

had failed to claim a dependent exemption.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3