Form Mf-26 - Application For Liquid Fuels Carrier'S License And Certificates Page 2

ADVERTISEMENT

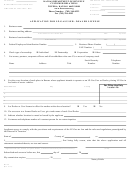

17.

Have you or any partner, corporate officer or stockholder owning more than 5% of company stock had a motor fuel license revoked for cause in

another state?

Yes

No

18.

Do you or any partner, corporate officer or stockholder owning more than 5% of company stock intend to carry on the business authorized by the

license as agent of another?

Yes

No

19.

If you answered yes to any question 14-19, please explain on a separate sheet of paper.

State of

,

County of

, ss:

I,

, first being fully sworn, state that the above application, and all statements contained

(Print Name)

therein, are true and correct under the penalty of perjury.

(Signature of Owner, Partner, Corporate Officer, or Person Authorized by Attached Power of Attorney)

(Title)

Subscribed and sworn to before me, this

day of

20

My commission expires

20

(Notary Public)

INSTRUCTIONS

Line 9 MAKE AND YEAR—This can be abbreviated, as an example, "IHC' 96" or "Chev' 99."

KIND OF VEHICLE—Show whether vehicle is a Truck or Truck-Tractor.

VEHICLE IDENTIFICATION NUMBER (VIN)—On a truck or truck-tractor, give the VIN only. It is not necessary to

describe the semi-trailer.

CARRYING CAPACITY—This figure (in gallons) is to be inserted if the cargo carrying capacity of the vehicle is 120 gallons

or more, up to and including 3,500 gallons. If vehicle is a truck-tractor, show cargo carrying capacity of towed unit.

•

ITEM (13)—KAR 92-3-6. States marking of vehicles transporting liquid fuels. Each vehicle used in transporting liquid fuel,

which is subject to the law pertaining to the transportation of liquid fuel, shall be marked or lettered as follows: (a) The liquid fuel

carrier's name and address shall appear in plain letters not less than two inches in height on a sharply contrasting background on

each side of the vehicle; (b) The liquid fuel carrier's license certificate number shall appear in plain letters not less than two inches

in height on a sharply contrasting background on each side of the vehicle.

•

WHO MAY SIGN APPLICATION—Only the Individual Owner; Partner; Corporate Officers; listed on the application or a person

who has been duly authorized as Attorney-in-fact by proper Power of Attorney which has been filed in this office; may sign the

application.

•

VEHICLES SOLD, LEASED, OUT OF SERVICE—When any vehicle which has been licensed is no longer used or has been sold

or leased, under a long term lease, to another carrier, the LFCL certificate should be sent in immediately with written instructions

for cancellation. If the certificate has been lost, send in letter with vehicle information to request the license be canceled.

•

You must report any change in ownership including a change in partners, corporate offices or stockholders owning 5% or more of

company stock within 30 days of the change.

•

ENCLOSE FEE OF $10.00 PER VEHICLE

This completed application or inquiries concerning this application should be directed to:

CUSTOMER RELATIONS

MOTOR FUEL TAX

KANSAS DEPARTMENT OF REVENUE

915 SW HARRISON ST

TOPEKA, KANSAS 66625-8000

OR

PHONE: (785) 368-8222

FAX: (785) 296-2703

MF-26 (Rev. 06/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2