Instructions For Property Owners And Sample Tangible Personal Property Tax Return Form

ADVERTISEMENT

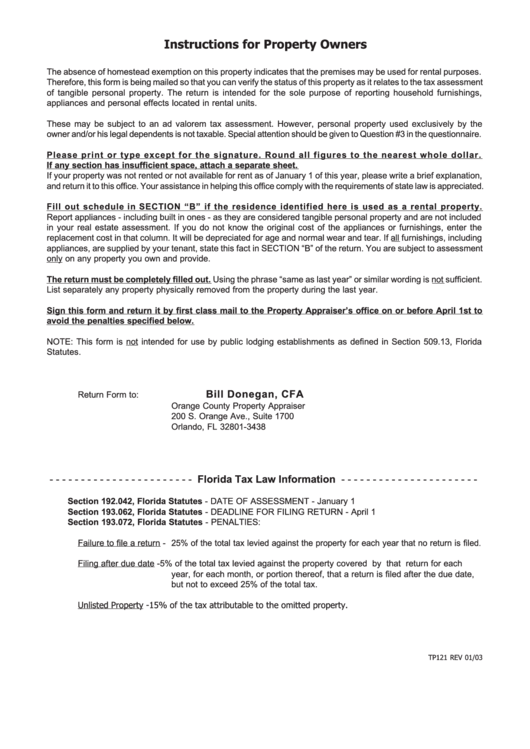

Instructions for Property Owners

The absence of homestead exemption on this property indicates that the premises may be used for rental purposes.

Therefore, this form is being mailed so that you can verify the status of this property as it relates to the tax assessment

of tangible personal property. The return is intended for the sole purpose of reporting household furnishings,

appliances and personal effects located in rental units.

These may be subject to an ad valorem tax assessment. However, personal property used exclusively by the

owner and/or his legal dependents is not taxable. Special attention should be given to Question #3 in the questionnaire.

Please print or type except for the signature. Round all figures to the nearest whole dollar.

If any section has insufficient space, attach a separate sheet.

If your property was not rented or not available for rent as of January 1 of this year, please write a brief explanation,

and return it to this office. Your assistance in helping this office comply with the requirements of state law is appreciated.

Fill out schedule in SECTION “B” if the residence identified here is used as a rental property.

Report appliances - including built in ones - as they are considered tangible personal property and are not included

in your real estate assessment. If you do not know the original cost of the appliances or furnishings, enter the

replacement cost in that column. It will be depreciated for age and normal wear and tear. If all furnishings, including

appliances, are supplied by your tenant, state this fact in SECTION “B” of the return. You are subject to assessment

only on any property you own and provide.

The return must be completely filled out. Using the phrase “same as last year” or similar wording is not sufficient.

List separately any property physically removed from the property during the last year.

Sign this form and return it by first class mail to the Property Appraiser’s office on or before April 1st to

avoid the penalties specified below.

NOTE: This form is not intended for use by public lodging establishments as defined in Section 509.13, Florida

Statutes.

Bill Donegan, CFA

Return Form to:

Orange County Property Appraiser

200 S. Orange Ave., Suite 1700

Orlando, FL 32801-3438

- - - - - - - - - - - - - - - - - - - - - - - Florida Tax Law Information - - - - - - - - - - - - - - - - - - - - - -

Section 192.042, Florida Statutes - DATE OF ASSESSMENT - January 1

Section 193.062, Florida Statutes - DEADLINE FOR FILING RETURN - April 1

Section 193.072, Florida Statutes - PENALTIES:

Failure to file a return - 25% of the total tax levied against the property for each year that no return is filed.

Filing after due date -

5% of the total tax levied against the property covered by that return for each

year, for each month, or portion thereof, that a return is filed after the due date,

but not to exceed 25% of the total tax.

Unlisted Property -

15% of the tax attributable to the omitted property.

TP121 REV 01/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2